THE TAKEAWAY

What the Kardashians can teach your FI about fintech partners to identify niche markets.

- In collaboration with Stessa Cohen, independent banking analyst, and consultant

Our latest whitepaper guides you through how to bring a differentiated, digital-first banking product to market.

Successfully target niche markets (especially Millennials and Gen Z) with unique features that act as a customer-adoption magnet by solving their unique needs and wants. Plus the key steps to choosing the right fintech partnerships to help you launch compelling products quickly with your niche market in mind.

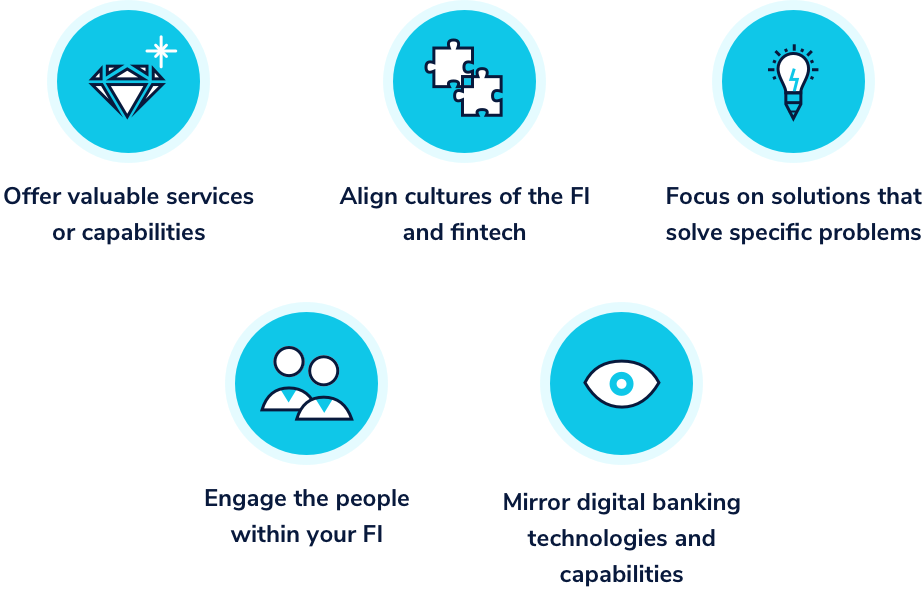

We’ve put together a downloadable whitepaper to walk you through the 6 integral characteristics of a helpful fintech partnership with the all-important aim of attracting new customer demographics. Specifically, the ever-growing market of Millennial and Gen-Z customers.

Serving the unique needs of these groups involves building differentiated and digital-first banking products and compelling features with unique value propositions, and bringing these to market quickly.

This whitepaper includes:

|

Full example models, case studies, and easily digested key points. |

|

Six chapters full of detailed insight, combining our industry knowledge with some exemplification help from the Kardashian Kard. |

|

Cultivated deep dives into signposts to look out for when identifying these niche markets and how to attract them to your FI. |

|

Step by step guide to jump start your digital-first transformation. |

Your one-stop handbook to making your fintech partnerships work and best reflect the outcomes required to push your product offer to the right niche market.

Alongside Nymbus, we’ve dug deep into the teachable moments from a fintech perspective in the development and rollout of the Kardashian Kard.

Most importantly, how choosing the right fintech partner can open up the best choices for identifying niche markets and product success.