THE PREMIER FINTECH CONSULTING COMPANY

Outdated to Outstanding:

Build a Fintech Product That Wins More Clients

What’s the cost of slow releases, clunky interfaces, and internal resistance? How many customers walk away before you act? Why wait when the solution is clear? The time to transform is now.

Get your transformation strategy session now →

Book a transformation strategy session with our fintech experts.

Will you be next?

Will you be next?

A fintech software development company that builds market-leading products.

You need a partner who knows financial technology. You need an expert with hands-on modernization experience. You need a team that builds market leaders. Every customer expects more, every competitor moves faster, every delay costs growth.

The industry moves fast. The best move faster.

Fintech digital transformation services that deliver real results.

A slow product kills growth.

That changes with research-backed digital experience, streamlined workflows, and modern architecture. Faster releases, higher retention, better sales demos. Every second lost is a competitive edge given away. Move now, modernize with us.

Praxent quickly evidenced their ability to add value beyond the tech build. They’re very knowledgeable about the space and understood the depth and breadth of our project.

As the battle for deposits persists, our High-Yield Savings solution needed to help banks better compete and retain relevance. That is why we joined forces with Praxent; the Praxent team shares our intense commitment to delivering successful outcomes for each institution and end user.

They work faster than we are, so we’re just trying to keep up with them. The Praxent team has been open and transparent about what they’re doing, making our job easier because we see where they are with the timelines.

Praxent’s banking expertise has impressed me the most. I did my due diligence and searched for vendors with deep banking experience — Praxent had this. They also had proper operational and program management discipline. In other words, they not only had the subject matter expertise we needed; they could also help us with its execution.

Gain a competitive edge with digital transformation and faster innovation.

Right now, markets shift faster than you expect.

Because 48% of FI buyers drop fintech vendors over poor demos, your lost prospects may surge if you hesitate. Your UX, your features, your roadmap - they all signal your ability to change. Speed defines market leaders; hesitation defines those left behind. Remove friction, speed up releases, and keep buyers engaged.

Modernize, accelerate, lead because standing still isn’t an option.

Yesterday’s technology can’t meet today’s demands.

Faster releases, elevated UX, and scalable architecture - each delivers real impact. Some teams push valiantly despite the friction, struggling against rigid systems incapable of change. Others glide forward with modular architecture, API integrations, and UX/UI redesigns that unlock growth. The choice isn’t between change or stability, it’s between relevance or obsolescence.

UX/UI Redesign

Your fintech product will outperform because we design for impact.

Every tap, scroll, and interaction matters when friction costs you customers. We refine user journeys, cut through complexity, and build trust. Competitive research, persona-driven design, and frictionless interfaces ensure your product is so good, it sells itself.

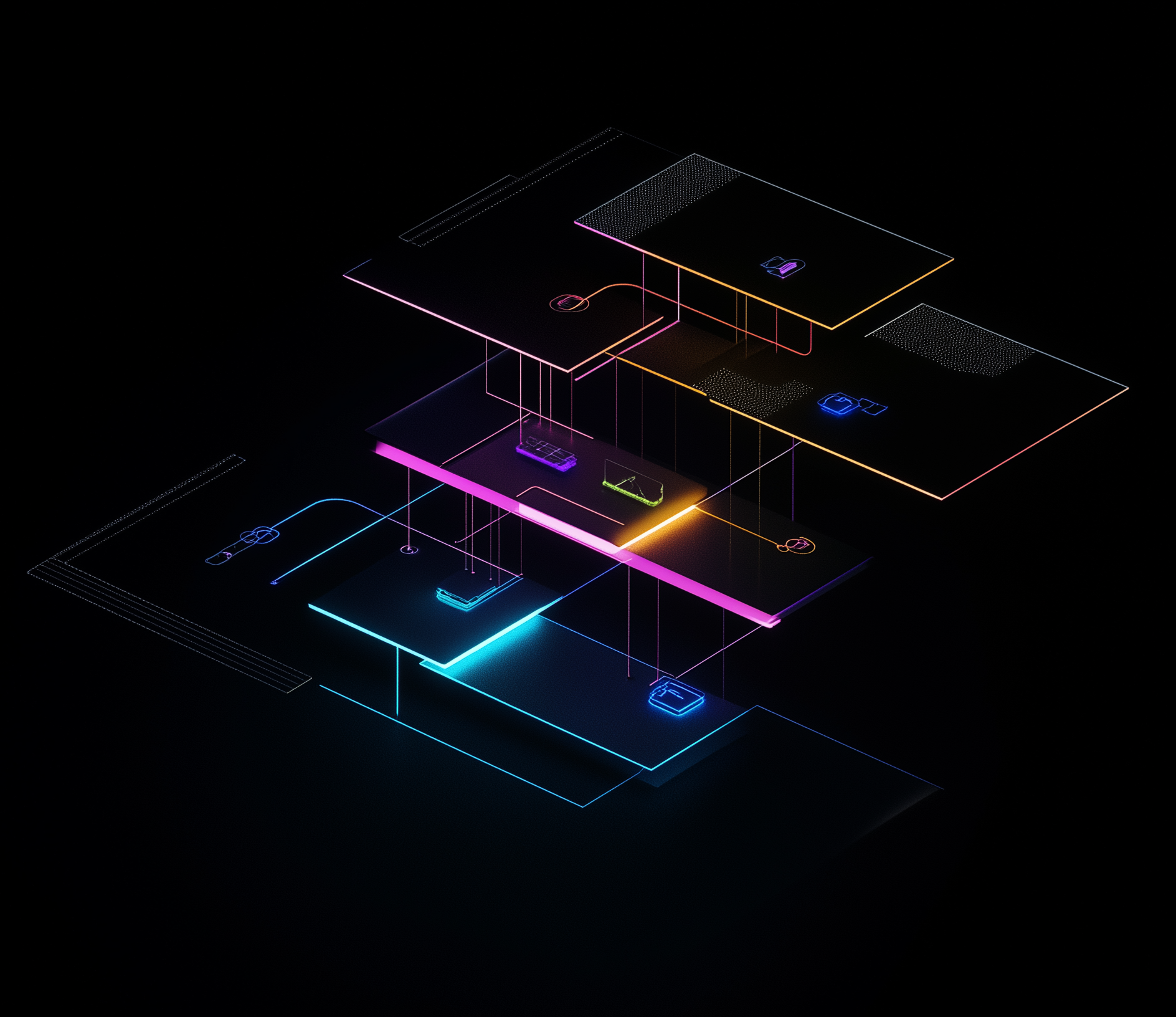

System Modernization

Move forward. Your fintech can’t keep up with rigid, outdated systems.

Legacy systems slow you down, weaken security, and limit scale. Microservices, cloud migration, and DevOps change that. With us, there's no business logic lost, no functionality compromised, no milestones missed. Smarter workflows, modular systems, faster releases, scalable growth. Built to last, built to win, built for what’s next.

Business Process Optimization

Fix the friction in your digital workflows.

Outdated banking and lending processes slow decisions, slow conversions, frustrate customers, and block growth. We uncover all business logic, including edge cases, capture the real processes your teams follow, then push further to design the best experience for now and the future. What you get isn’t just an upgrade. It’s a competitive advantage.

API Integrations

How fast can your fintech connect to the right partners? Not fast enough?.

The real challenge isn’t just development speed, it’s security, scalability, and compliance. We simplify integrations, build middleware that scales, and accelerate your ability to connect with leading fintechs and data providers. We power over 50 fintech integrations a year meaning faster launches, stronger security, and seamless compliance.

Application Development

Modern frameworks demand modern execution.

We accelerate development, close skill gaps, and ensure seamless rollouts. Whether modernizing or rebuilding, our senior experts bring best practices, hands-on training, and precision. Teams trust us to deliver, and the results speak for themselves. On time, on budget. For us, success isn’t an accident, it’s engineered.

AI Development

Manual workflows slow growth, introduce risk, and limit scalability, AI changes that.

AI accelerates decisions, AI enhances service, AI eliminates inefficiencies. Underwriting, customer support, fraud detection, compliance, the AI solutions we've delivered drive real results. The market isn’t waiting, and neither should you. Stay ahead, or fall behind.

Modular Architecture

You can keep struggling with rigid, outdated systems, or embrace modular architecture for agility and speed.

Faster releases, easier updates, and a scalable foundation—without the technical debt. The right architecture transforms development from a bottleneck into a growth engine, ensuring your business leads instead of lags.

Cloud Strategy

Your customers expect flawless uptime for every second, every transaction, every interaction.

A single failure erodes trust, revenue, and retention. BFSI compliance, cost control, cloud scalability—AWS, Azure, GCP, hybrid, on-prem—we architect it all. We automate security, we optimize cost, we future-proof infrastructure. Reliable. Agile. Secure. Anything less isn’t good enough.

Data Centralization

Your data isn’t an asset if it’s scattered, inconsistent, and unreliable.

Missing insights. Bottlenecked workflows. Compliance risks. Your data is everywhere, moving all around, but never where you need it. Centralized, governed, and optimized data means real-time insights, streamlined decisions, and technology that actually works for you.

DevOps Processes

Your developers aren’t slow, your pipelines are.

Manual testing drags, fragmented workflows stall, security gaps linger. A broken release process leaks time, effort, and momentum. Cut cycle times and deploy reliably. Automate, accelerate, integrate. The result? Faster releases, fewer failures, and a development team that thrives.

JUMPSTART YOUR PROJECT

Speak to our fintech experts.

Banktech that sells itself

Your banktech shouldn’t just work, it should win.

Core systems must integrate, account opening must be effortless, digital banking must be intuitive, card management must work flawlessly. If it’s slow, clunky, or unreliable, banks walk away. Build, refine, and accelerate with a partner who ensures your banktech stands above the rest.

Payments built for speed

Payments that lag lose customers.

But what if transactions were instant, seamless, and fraud-resistant? Security must be airtight, compliance non-negotiable, scalability effortless. Slow, outdated systems cost more than time, they cost trust. Work with us to eliminate friction, reduce risk, and scale without compromise.

Lendtech built to convert

Lending technology either drives deals or drags them down.

Faster decisions, faster approvals, faster servicing. Without delays, without bottlenecks, without friction. Auto, mortgage, SMB, commercial—built for every need, built for every lender, built for every deal. Smarter workflows, stronger integrations, sharper AI decisioning. So, will your platform lead the market, or follow it?

Wealthtech designed to dominate the market

Wealth management thrives on trust, engagement, and seamless access.

Yet, many wealth expereinces suffer from fragmented tools, complex onboarding, unfriendly interfaces. Let's bridge the gap. Drive adoption and deepen loyalty with frictionless account opening, intuitive portfolio management, and real-time performance insights. Slow innovation loses investors. Work with us to modernize, integrate, and scale.

SPECIALIZED EXPERTISE IN INSURANCE PLATFORM MODERNIZATION

The Praxent Difference.

Our commitment to quality goes far beyond technology. We’re not a global consulting conglomerate; we’re a boutique team of experts in financial technology with a sharp focus on insurance.

🞪 No one-size-fits-all frameworks, 🞪 no two-year contracts, 🞪 no mass out-sourcing to teams outside your time zones, 🞪 and no fresh graduates. Just a targeted team with hands-on experience dedicated to solving your problems.

Our goal is to leave your team better than when we started. Think of us as part of your team. Everyone else does.

OUR PROVEN FINTECH TRANSFORMATION PROCESS.

4 steps to lead the market.

Market-Leading Strategy

Elevated User Experience Design

Future-Proof Technology, Delivered

Seamless Handoff

OUR WORK

The premier fintech consulting company that transforms legacy fintechs into market leaders

Seen enough wins? Now, let's talk about yours. Book a call →

Thoughts from our Fintech

Modernization Experts.

Closing the Gap: How Fintechs Can Level Up Without Starting Over

Modernize your fintech platform without a full rebuild. Learn how top teams reduce friction, boost adoption, and accelerate innovation in 2025.

5 Fintech Trends That Will Reshape How You Sell in the Boardroom

Discover 5 fintech trends reshaping enterprise buying—AI, embedded finance, ESG, digital currencies, and cybersecurity.