THE DIGITAL AUTO-FINANCE EXPERTS

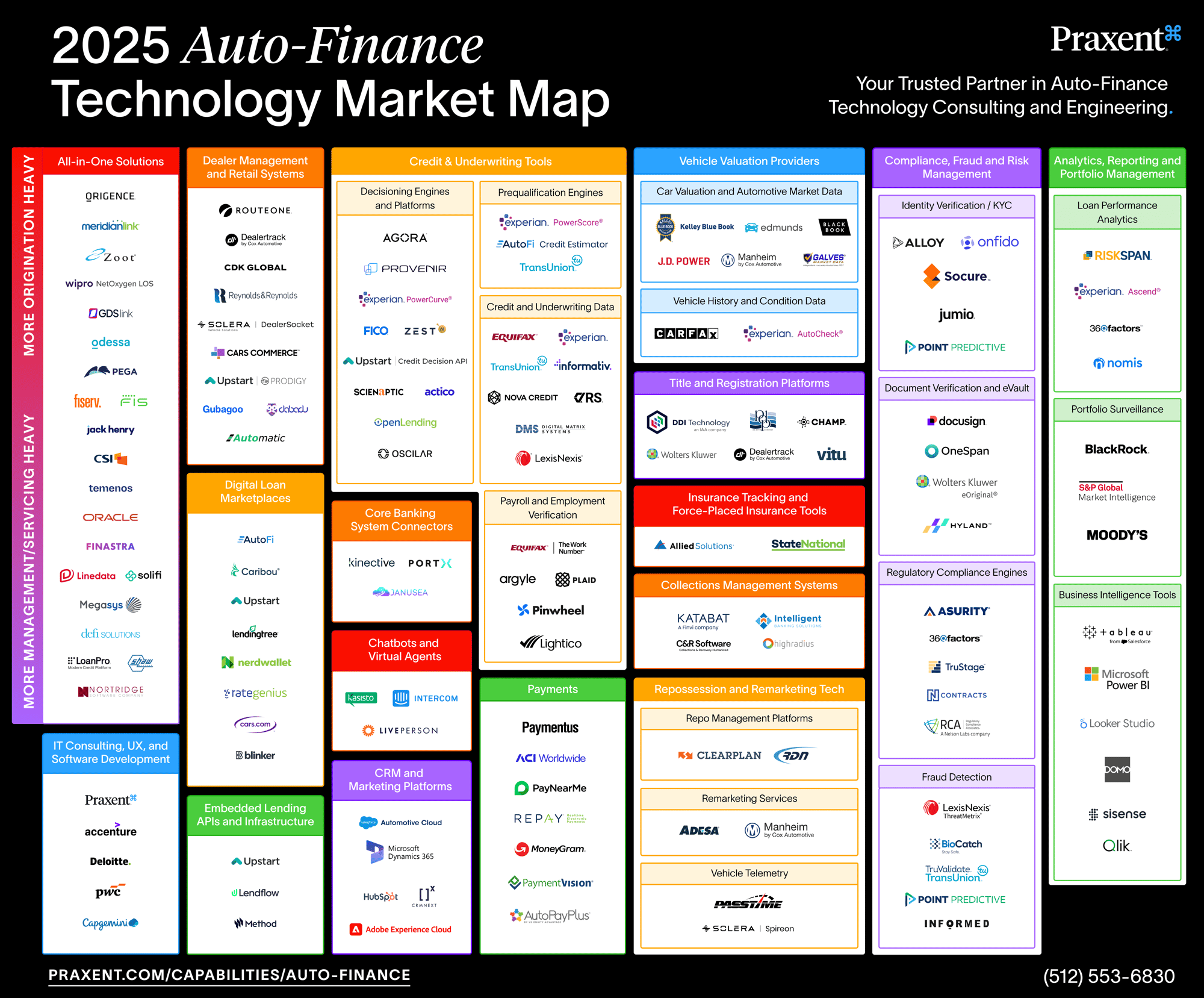

2025 Auto-Finance Technology Ecosystem Market Map

Produced by Praxent, a technology consulting and engineering firm that helps auto lenders modernize their technology platforms. We design, build, and integrate lending software that delivers faster decisions, better workflows, and borrower experiences that convert. Get in touch.

The auto-finance tech ecosystem in North America is composed of many integrated components, each serving a role in the loan lifecycle.

This map breaks down major categories of the auto lending technology stack – from loan origination and dealer-facing systems to credit decision engines, verification tools, servicing platforms, and beyond.

Under each category, we outline key subcategories and vendor solutions (with websites and tags indicating their niche or popularity). Auto lending executives and platform leaders can use this as a reference to plan digital transformation, evaluate vendors, and understand how pieces of the tech stack fit together. We also highlight vendors offering all-in-one platforms spanning multiple functions.

(Note: This list is not exhaustive, and only vendors active in the North American market are included).

All-In-One Solutions

All-In-One Solutions are comprehensive lending platforms that support multiple stages of the auto loan lifecycle within a single system. These platforms blend the capabilities of Loan Origination Systems (LOS) and Loan Management/Servicing Systems (LMS), allowing lenders to handle everything from application and underwriting to servicing and collections.

Some solutions in this category skew toward front-end loan origination (LOS-heavy), while others emphasize back-end servicing (LMS-heavy), but all provide broad, end-to-end functionality.

By using an all-in-one platform, auto lenders can streamline workflows, maintain a single source of truth for loan data, and improve efficiency and compliance across the lending process.

Origence provides lending technology solutions for credit unions. The company offers two main solutions: Origence arc, a loan and account origination system (LOS) for direct and indirect lending that features intelligent underwriting technologies, and the CUDL platform, which connects automotive dealerships to credit union financing.

A cloud-based consumer loan origination and decisioning system that consolidates applications from all channels and automates workflows for personal loans, auto loans, and other consumer lending products.

Zoot is a global provider of advanced instant credit decisioning and loan origination solutions. Its cloud-based platform delivers millisecond real-time decisions and workflow management, helping lenders automate underwriting and risk management. Zoot’s decision engine orchestrates data from hundreds of sources to enable fast credit decisions with high flexibility.

An end-to-end loan origination solution that automates auto lending from point-of-sale application through underwriting and interim servicing, helping lenders quickly close consumer and auto loans with a cloud-ready, configurable platform.

A combined origination and AI-driven lending decisioning platform integrating real-time data, advanced analytics, and automated workflows to streamline loan originations and credit risk management for auto and other loans.

Provider of the Odessa Platform (formerly LeaseWave) for auto and equipment lease/loan management. Used by large leasing companies and some captives, Odessa handles originations through servicing with a focus on asset-based finance.

Offers a low-code automation platform for lenders to digitize loan and lease origination, decisioning, and servicing. Automating processes and administrative tasks, increasing the speed and efficiency of auto financing operations on a unified system.

Global fintech and payments company providing an integrated end-to-end automotive lending suite (software and BPO services) supporting lenders from loan/lease origination through account servicing and even vehicle disposition, scalable for institutions of all sizes and tied to Fiserv core systems.

Another global fintech and payments company providing a comprehensive auto and equipment finance platform (formerly CMSI's Origentate and Ambit Asset Finance) that streamlines the lending process with a highly automated, integrated solution that consolidates loan/lease origination, servicing, portfolio management, and collections in one system.

A flexible, all-digital lending platform that uses a one‐system approach to reduce friction across the entire loan lifecycle, centralizing data from application through underwriting, approval, and monitoring and tied to Jack Henry core systems.

A core banking provider with integrated digital lending solutions. CSI's platform allows customers to apply for loans anywhere and streamlines consumer and commercial lending processes from origination to servicing.

A global banking software suite with integrated lending modules for flexible loan origination, decisioning, and servicing for direct and indirect lending. It supports real-time indirect applications, multi-product structuring and funding. Built to scale, offering advanced automation, decisioning, and seamless third-party integrations to make the lending process efficient and adaptable.

Oracle’s OFSLL is a comprehensive loan and lease management platform used by auto finance companies (captives, banks) for end-to-end servicing. It supports loan and lease accounting, customer service, collections, and recovery on a single platform. OFSLL handles multi-product portfolios (auto loans, leases, lines of credit) with robust enterprise features (e.g., multi-currency, role-based security, and integration to general ledger). Best for enterprise, it's highly scalable but requires significant IT resources to maintain.

A fintech provider offering a comprehensive lending suite (Fusion) that digitizes the entire loan process, from online loan applications and automated underwriting to servicing and compliance. An API-first platform helping banks and credit unions modernize consumer and auto lending.

Provider of Linedata Ekip360, a configurable end-to-end software solution for automotive and equipment finance. It supports fully configurable workflows that drive contracts from origination through funding, and it serves as a complete contract management/servicing system post-booking.

Delivers an open finance platform for automotive and asset finance. Its SaaS solutions (originating from White Clarke’s CALMS) provide end-to-end support for lease and loan origination, with workflow automation from first customer interaction through documentation and portfolio management. Global solution, popular with captives and independents (end-to-end leasing & lending).

Megasys developed the Omega loan management system, a servicing platform popular with subprime auto finance and “Buy Here, Pay Here” lenders. Omega handles the full loan servicing cycle – from contract booking to collections – tailored for auto loans with features like tracking collateral, GPS, and dealer profit sharing.

defi SOLUTIONS is a cloud-based lend-to-end platform (LOS + LMS + analytics + BPO services) platform that helps captives and independents seeking modern tech, automate and manage lending programs, configuring rules and workflows to improve efficiency.

Shaw Systems provides an integrated loan and lease servicing software solution designed for retail installment lending. It handles loan accounting, lease management, insurance and fee processing, as well as dealer reserve (holdback) processing. Shaw’s system is used by banks, auto-finance companies, and specialty lenders to manage loan portfolios, including support for add-on products and various fee structures.

LoanPro is a modern, API-first loan management platform (SaaS) that enables lenders to service any type of installment loan with high configurability and automation. It’s a composable cloud platform where lenders can set up billing schedules, collections workflows, and customer portals. LoanPro’s open API allows easy integration for payments and accounting. Favored by newer fintech auto lenders and finance companies wanting more flexibility than legacy systems. Often integrated with direct-to-consumer auto refinance platforms.

Nortridge is a cloud-enabled, enterprise loan servicing system expanding to offer origination as well. Known for flexibility, it offers highly configurable loan setup, payment schedules (installment, revolving, etc.), and workflow automation for servicing loans and leases. Nortridge supports the entire servicing lifecycle (billing, collections, investor reporting) with strong multi-branch and security features. Popuplar with subprime and BHPH finance.

A modular lending platform designed around your exact workflows. API-first, cloud-native, and fully branded. Own every part of the borrower, underwriter, and dealer experience without being limited by legacy vendor constraints. Built for lenders who want complete control, faster innovation cycles, and the ability to stand out in a crowded market.

Explore our custom built Auto Finance solutions →

Built to move faster from app to funding. A custom LOS gives you full control over credit policies, stip workflows, integrations, and user experience. Use AI-assisted data validation, plug-and-play integrations, and dynamic form logic to deliver personalized customer journeys and lightning-fast approvals. Designed for auto lenders frustrated by off-the-shelf limitations, and ready to invest in infrastructure they own and can evolve as fast as the business does.

Explore our custom built Auto Finance solutions →

Launch a fully branded self-service portal where borrowers view balances, schedule payments, get instant payoff quotes, upload documents, and interact with AI-powered chat support. Fully owned and extensible, you can integrate with any LOS, LMS, CRM, and analytics for seamless engagement and agility.

Explore our custom built Auto Finance solutions →Dealer Management and Retail Systems

Dealer Management and Retail Systems sit at the intersection of auto retail and financing. These platforms serve as the front lines of indirect lending, where the consumer, dealer, and lender converge. For lenders, deep integration with these systems is not optional. It’s how applications get submitted, contracts are signed, deals are funded, and vehicle and borrower data flows are validated.

This category includes:

- Dealer Management Systems (DMS): Core operational platforms used by franchise and independent dealers (inventory, desking, F&I, service)

- Dealer-Lender Credit Portals: Platforms like RouteOne and Dealertrack that enable indirect loan application routing and eContracting

- Digital Retail Platforms: Embedded financing tools powering online car shopping and omni-channel retail experiences

- Dealer CRM Tools: Platforms for managing customer relationships, follow-ups, and cross-channel lead activity

For lenders building platform strategies, these systems determine the source and quality of loan volume, and directly impact dealer satisfaction, app speed, compliance, and conversion.

RouteOne is a dealer finance platform (founded 2002 as a joint venture of major auto lenders) connecting 20,000+ dealerships with 1,400+ finance sources for credit applications and eContracting. Its system streamlines F&I by enabling faster credit decisions and funding, improving the dealer-customer experience.

Dealertrack, part of Cox Automotive, provides a suite of solutions for dealers and lenders – including a leading credit application network, electronic contracting, dealer management system (DMS), and title management. These connected solutions help manage F&I processes and titling to improve efficiency and profitability.

CDK Global is a top dealer management system provider offering dealership software for inventory, sales, F&I, and service. Its DMS integrates with lending networks to send credit apps and contracts electronically, helping dealerships and lenders transact seamlessly.

Reynolds & Reynolds provides dealership management systems and retailing software. Its platform supports F&I paperwork, forms, and integrates with networks like RouteOne for credit applications, helping dealers and their preferred lenders speed up the vehicle finance process.

DealerSocket offers automotive CRM and dealership software to manage leads, sales, and customer relationships. It helps dealers nurture customers through the sales/finance pipeline, integrating with DMS and lender portals to improve sales and F&I performance.

Digital retail platform owned by Cars.com. Offers online deal building, finance lead capture, and integration with dealer websites and lender APIs.

Prodigy is a digital sales and F&I platform that lets dealerships desk deals online or in-store with real-time lender offers. Acquired by Upstart and rebranded Upstart Auto Retail, it integrates AI-driven loan offers into the showroom experience, allowing for instant loan decisions during the car buying process.

Early-stage digital retail platform providing white-labeled online storefronts for auto dealers with integrated credit apps and lender routing.

Startup platform offering lead capture, credit app tools, and digital finance journey tools for independent dealers.

Fintech platform for independent dealers. A one-stop marketplace to connect with multiple lenders for instant approvals.

Digital Loan Marketplaces

Digital Loan Marketplaces serve as third-party origination funnels for lenders generating consumer demand, capturing applications, and routing qualified leads to lender partners for fulfillment. These platforms span multiple models: some act as aggregators connecting borrowers to lenders via rate shopping tools; others operate as full-stack marketplaces that handle credit decisioning, pre-qualification, and contracting flows before delivering a booked or nearly-ready loan to a lender.

For lenders, digital loan marketplaces are a lever for growth. They offer exposure to new borrower segments, access to pre-qualified loan volume, and analytics on funnel performance. However, they also introduce price competition and data standardization requirements. The best lenders integrate via API and develop feedback loops to optimize approval and funding rates.

AutoFi provides a commerce platform enabling auto dealers to sell vehicles completely online by connecting buyers with lenders in a fast, easy, and transparent process. Partners with major lenders (e.g. Santander, Chase) to present real-time loan offers on dealer and OEM websites. Its platform offers a point-of-sale financing solution that integrates lender offers into dealer websites and showrooms, accelerating F&I and enabling “online checkout” for car buyers.

Caribou is a refinance marketplace that partners with credit unions and banks to originate auto refinance loans through a consumer-first digital flow. Offers real-time rate comparisons and DMS integrations.

Upstart Auto uses AI models and embedded lending infrastructure to power auto refi and purchase loans via its own marketplace and dealer network. Offers pre-qual, credit decisioning, and funding workflows.

LendingTree operates a multi-lender marketplace that captures borrower interest in auto loans and refis, matches to lenders, and routes leads through digital or agent-assisted funnels.

NerdWallet’s loan marketplace enables users to compare auto refi and purchase offers, typically routing users to partner lender sites via soft credit pulls or rate estimation widgets.

RateGenius is a leading auto refinance marketplace matching borrowers with partner lenders through a dedicated digital and phone-based loan advisory team. Focuses heavily on subprime and near-prime.

CreditIQ, owned by Cars.com, integrates real-time prequalification into dealer vehicle listings. Delivers finance-ready leads to lenders and dealers with embedded application flows.

Blinker is a peer-to-peer vehicle marketplace that includes lending, titling, and service options directly in the purchase flow. Enables buyers to finance private-party vehicle purchases online.

Embedded Lending APIs and Infrastructure

Embedded Lending APIs and Infrastructure providers enable lenders to distribute credit products through non-traditional channels by powering prequalification, underwriting, and booking within third-party environments. These platforms allow digital retailers, marketplaces, service providers, and fintechs to embed auto finance into their native experiences from car shopping and insurance apps to repair portals and employer benefits platforms.

Unlike traditional LOS or POS systems, embedded lending infrastructure sits behind the scenes. It provides developer-friendly APIs and orchestration layers for credit decisioning, data aggregation, compliance, and loan servicing integration. For auto lenders, this model expands distribution, accelerates innovation, and enables faster market entry without owning the entire UX layer.

Upstart offers embeddable credit decisioning APIs backed by AI underwriting. Lenders can plug into Upstart’s infrastructure to power real-time prequal, decisioning, and funding across third-party channels.

Methodfi connects consumers’ liabilities across banks and lenders via APIs, enabling real-time debt access, account payoff, and balance transfers. Supports embedded refi, auto payments, and liability-aware experiences.

Lendflow provides a lending infrastructure layer that lets software companies and fintechs embed credit products directly into their workflows. Includes underwriting, data, KYC, and loan orchestration APIs.

Credit and Underwriting Tools

Credit and underwriting tools determine how fast, how accurately, and how competitively an auto lender can assess risk and make loan decisions. This technology layer includes the systems and data services that sit between loan application intake and final approval or decline. For technology leaders, this is a strategic part of the stack, not a back-office function. It drives borrower conversion, approval rates, loss ratios, compliance posture, and even capital treatment.

In modern auto lending, underwriting is not a monolith. It’s composed of integrated capabilities across four primary subcategories:

- Workflow Automation, Risk and Decisioning

- Prequalification Engines

- Credit and Underwriting Data

- Payroll and Employment Verification

Decisioning Engines and Platforms

Decisioning Engines and Platforms are the backbone of scalable credit operations. These systems ingest application and bureau data, apply credit policies, run decision models, and return approve/decline responses, often in milliseconds. For auto lenders, modernizing this layer directly impacts speed-to-decision, approval rates, loss ratios, and compliance.

The category includes configurable decision engines, AI-driven credit modeling platforms, and orchestration tools that unify data ingestion, rule execution, and risk governance. Some vendors focus on enabling rule-based logic and compliance; others specialize in AI underwriting and alternative data. A few extend into full-stack credit orchestration or risk-as-a-service for auto-specific contexts.

This layer is often integrated into the LOS but functions as a distinct engine powering credit outcomes. Strategic investments here separate high-performing platforms from legacy-bound peers.

Agora Data provides AI-driven capital solutions and loan analytics for subprime auto lenders. Its platform uses machine learning on $350B+ of subprime loan data to predict performance and enable securitizations. Lenders gain access to affordable funding and tools to safely expand non-prime lending.

Provenir offers a cloud decisioning platform that automates credit risk and fraud decisions in real time. Auto lenders use Provenir’s low-code engine to integrate data and deploy AI-powered underwriting models quickly. The platform’s flexibility lets business users adjust rules on the fly for faster approvals.

Experian’s PowerCurve is an automated decisioning suite that helps auto lenders design and execute credit strategies. It combines Experian’s extensive credit data with a flexible rules engine, allowing instant processing of applications. Lenders use PowerCurve to streamline approvals and adjust underwriting as market dynamics change.

FICO’s decision management platform (part of the FICO Platform) lets auto lenders automate loan underwriting using predictive analytics and FICO Scores. It provides real-time risk assessment from application through account management. Lenders can configure rules and models to consistently apply credit policy and instantly approve or decline applicants based on risk thresholds. It ensures uniform, explainable decisions and supports regulatory compliance with built-in scorecards.

Zest AI is a pioneer in AI-driven credit underwriting technology with a mission to broaden access to lending through smarter, more inclusive models. Zest’s platform builds custom machine learning credit models for lenders, enabling higher approvals and more accurate risk prediction while maintaining fairness. It’s used by banks, credit unions, and auto finance companies to boost approval rates and reduce default risk for thin-file borrowers.

Upstart offers an AI-powered credit decision API that banks and auto lenders can embed in their workflows. It uses over 1,600 data points and machine learning models to instantly underwrite auto loan applicants beyond traditional credit scores. Lenders retain control of credit policy while Upstart’s models help approve more “near-prime” borrowers with accurate risk-based pricing. Known for increasing approval rates and lowering defaults by evaluating factors like education and employment.

Scienaptic provides an AI-powered credit decisioning platform focused on financial inclusion. Popular with mid-tier banks & credit unions Scienaptic helps lenders say “yes” more often without increasing risk by leveraging alternative data and machine learning.

Actico provides a digital decisioning platform that combines a business rules engine with AI for credit underwriting. Auto lenders use Actico’s graphical drag-and-drop interface to model underwriting rules, integrate ML models, and automate loan decisions. It supports real-time scoring (e.g., risk, pricing) and can seamlessly incorporate bureau data and custom calculations into the workflow.

Open Lending enables financial institutions to safely extend loans to near-prime and subprime borrowers by providing an automated underwriting platform with default insurance. Its flagship Lenders Protection™ program wraps auto loans with an insurance policy, reducing risk and allowing lenders to approve more applications.

Oscilar is an AI-driven risk decisioning platform that unifies fraud detection, credit underwriting, and compliance checks. Auto lenders can deploy Oscilar to analyze application data in real time and get a risk score or decision recommendation. The system’s machine learning models predict creditworthiness (e.g., likelihood of default) and flag fraud by examining patterns across multiple risk domains in one solution.

Purpose-built decisioning engine that blends rules and any data source you want to return decisions in seconds. Fully explainable, instantly adaptable, API-native, and integrated with any LOS. Best of all your decisioning logic is differentiated and kept secret from competitors. See how we helped one near-prime lender automate complex logic and deliver instant approvals with response times under five seconds.

Case Study ›

Underwriting flows and dashboards built for how your team actually works. Assign, escalate, and decision applications with tools tailored to your products, credit policies, and risk triggers. No more shoehorning your process into someone else’s system. Give underwriters better visibility, fewer manual steps, and faster turnaround across auto, refinance, and dealer channels. Best of all, you can save your underwriters from data janitorial work, finding the bottlenecks in their process and building solutions to reduce manual reviews, back-and-forth emails, and document clean up.

Explore our custom built Auto Finance solutions →Prequalification Engines

Prequalification engines enable lenders to present real-time, soft-pull credit offers before full application submission. These tools help borrowers see estimated loan terms without impacting their credit score and help lenders attract and convert more qualified leads. They’re commonly embedded in dealer platforms, direct-to-consumer flows, and digital loan marketplaces. Strategically, prequal tools increase funnel efficiency, improve borrower experience, and reduce manual processing by routing only eligible applicants into full underwriting. For embedded and digital-first lending, prequal APIs are foundational to delivering instant offer experiences.

Experian’s prequalification solution (sometimes referred to as PowerScore) lets auto lenders and dealers offer consumers a soft credit check to gauge eligibility for financing. It provides an instant credit snapshot (score and key attributes) without impacting the consumer’s FICO score. This helps match shoppers with loan offers they likely qualify for in real time.

AutoFi’s Credit Estimator is an online tool embedded in dealership websites that allows car shoppers to get prequalified by doing a soft credit pull. It shows buyers an estimated credit score and what monthly payment or vehicle price they can likely afford. The engine uses credit bureau data to tailor financing offers on the fly, helping align customers with appropriate vehicles and lenders.

TransUnion’s prequalification service enables auto lenders to perform a soft inquiry on applicants and return immediate feedback on potential approval terms. It leverages TransUnion’s credit file to provide a risk assessment without affecting the consumer’s credit score. Lenders can use it to present “prequalified” loan offers (APR, amount) online or in-showroom, streamlining the application process.

Credit and Underwriting Data

This category includes credit bureaus and third-party data aggregators that supply the core inputs for risk assessment. Traditional credit files (from Equifax, Experian, and TransUnion) remain central to most scorecards, but lenders increasingly incorporate alternative and enriched data: auto tradeline details, employment history, fraud risk, and consumer-permissioned data. These tools power risk segmentation, pricing models, fraud checks, and regulatory disclosures. Deep integration into LOS and decision engines is standard.

For lenders expanding beyond prime or optimizing pricing, richer data inputs are a competitive edge. Some lenders choose to rely on consolidators, which pull together credit reports from all three bureaus as well as alternative data, however, lenders must be careful to measure up-time, reliability, and speed as often direct integrations can enable faster decisions, however, it is more IT maintenance to manage.

Equifax is one of the “Big Three” credit bureaus, providing consumer credit reports and scores used in auto loan underwriting. Lenders pull Equifax data to evaluate applicants’ credit history (debts, payment record, auto loan experience) and often use Equifax’s auto-specific risk models (e.g., Insight Score for Auto) to predict likelihood of default. Equifax also offers income verification (The Work Number) as part of its underwriting data suite. A primary source for credit information. Auto lenders rely on Equifax to spot past auto loan performance and delinquencies. Its data powers many proprietary auto credit scores and is integral for compliance (e.g., providing risk-based pricing notices). Additionally, Equifax’s market analytics (like auto credit trends reports) help lenders benchmark portfolio performance.

Experian is a global major credit bureau that supplies credit data and analytics for auto finance decisions. Auto lenders obtain Experian credit reports and FICO® Scores to assess borrowers’ risk. Experian’s automotive unit also provides specialized data such as AutoCheck (vehicle history tied to borrowers) and demographic insights. Lenders leverage this to refine underwriting – for instance, seeing if a borrower has past auto loans or bankruptcies. Experian’s data is frequently used for prescreen campaigns and instant approvals in auto finance.

TransUnion is the third major credit bureau, providing credit reports, Vantage/FICO scores, and tradeline data for auto underwriting. Lenders consult TransUnion data to verify an applicant’s credit obligations and payment patterns. TransUnion often provides an “auto summary” on its reports (number of auto trades, loan balances) which helps underwriters gauge the applicant’s experience with vehicle financing. It also offers instant ID verification and fraud checks alongside credit data (now under the TruValidate suite). TransUnion’s insights (like whether a consumer has other recent auto inquiries or open auto loans) can influence approval and terms. The company also produces an Auto Loan Default Index and other industry studies that lenders track for portfolio risk trends.

CRS provides a unified credit data API that aggregates Equifax, Experian, and TransUnion information into one interface. Auto lenders integrate CRS’s API into their loan origination systems to pull tri-merge credit reports and scores seamlessly. The platform also offers add-ons like fraud checks and compliance (OFAC screening) in the same API call, simplifying the underwriting workflow to a single vendor solution. Commonly used by fintech lenders and dealer platforms to speed up application processing. CRS ensures consistency by deduplicating and merging bureau data, so lenders see one comprehensive report. It also helps with cost savings and maintenance – rather than managing three bureau connections, lenders manage one.

Nova Credit enables lenders to consider international credit history for immigrant borrowers. Through its Credit Passport®, Nova connects with credit bureaus in 20+ countries and translates foreign credit data into a U.S.-equivalent report and score. Auto lenders use Nova to underwrite “new-to-country” applicants who lack a U.S. credit file but have creditworthiness demonstrated abroad (e.g., in India, Mexico, Canada).

Informativ (formed from CBC, CreditDriver, etc.) offers an all-in-one credit, fraud, and compliance platform for auto dealers and lenders. It provides tri-bureau credit reports (with duplicate tradelines merged) instantly, along with Red Flag identity checks and OFAC screening. Informativ’s system proactively flags fraud (e.g., synthetic identities) and ensures lenders meet regulatory checks before booking an auto loan.

Digital Matrix Systems provides data access and analytics tools that help auto lenders harness multi-source credit data. Its flagship Data Access Point® gives a single pipeline to multiple credit bureaus and alternative data providers. DMS also offers derived credit attributes and scorecards (including an auto finance attribute set via partnerships) which lenders use to enhance their internal risk models and portfolio monitoring.

LexisNexis Risk Solutions offers a suite of fraud and identity products (e.g. ThreatMetrix, ID Proofing, and fraud risk scores) that auto lenders use to authenticate applicants and detect fraud. Often used at multiple points: origination (KYC checks), underwriting (fraud scores), and servicing (account takeover prevention). The platform combines digital identity insights (device, IP, behavioral analytics) with authoritative data (credit headers, public records) to flag suspicious applications.

Cut out delays, control error handling, and optimize bureau performance. Build a secure microservice that manages credit pulls across bureaus with unified logic. Gives your team more control over timing, exceptions, and audit logs. See how we built this for a lender scaling indirect auto loan originations and can rapidly accelerate yours with pre-built integration components.

Case Study ›Payroll, Employment, and Income Verification

These platforms validate employment status and income details to support underwriting, stipulation clearing, and fraud prevention. Some solutions (e.g. The Work Number) rely on employer-provided payroll data, while others (like Argyle or Pinwheel) connect directly to payroll systems or use bank data (Plaid) to infer income. These tools help replace manual stip collection, reduce time-to-fund, and improve automation rates. For lenders serving subprime or near-prime borrowers, accurate income verification is critical to mitigating default risk without delaying approvals. These platforms are especially helpful with non-traditional workers such as gig workers or self-employed workers.

The Work Number (by Equifax) is the largest employment and income verification database in the U.S. Auto lenders use it to instantly verify a borrower’s stated employment and income via payroll records from over 2.5 million employers. By querying The Work Number, lenders can obtain verified data (hire date, current pay, etc.) in seconds, reducing the need for paystubs or employer calls. Particularly useful for subprime and indirect lenders to combat inflated income claims. Many major auto finance firms have The Work Number integrated into their underwriting flow – if an applicant’s job is in the database, it provides a reliable source of truth. It also helps with speedy funding, as proof of income can be confirmed electronically on the spot.

Argyle is a consumer-permissioned payroll data API that gives auto lenders real-time access to an applicant’s income and employment info. With the borrower’s consent, Argyle connects directly to payroll providers or gig platforms to fetch up-to-date pay data, employment status, and even work hours. Ideal for reaching consumers not covered by traditional databases – e.g., gig economy drivers or contractors. Argyle’s platform can verify multiple income sources and provides continuous updates (streaming data) if needed. Lenders benefit from reduced fraud (harder to fake than a paper paystub) and improved approval rates for thin-credit borrowers by showing true income stability. This automation replaces manual steps (collecting paystubs, etc.), enabling faster, more accurate loan decisions.

Pinwheel offers an API for income and employment verification, similar in concept to Argyle. It connects to users’ payroll accounts (or bank accounts for direct deposit info) to pull source-of-truth income data in real time. Auto lenders can use Pinwheel to confirm an applicant’s job, salary, pay frequency, and even capture recent paystub details automatically, thereby speeding up verification and reducing the need for paper documents.

Lightico offers a digital completion platform for auto finance, streamlining customer interactions like eSignatures, document upload, ID verification, and payment capture via mobile. Through intuitive workflows, borrowers can remotely sign loan contracts, provide stipulations (proof of income, insurance), and complete funding requirements in minutes. Reduces loan funding time by up to 70–90% by eliminating paper and in-person steps. Frequently used in auto loan origination and servicing to boost customer satisfaction – borrowers can, for example, upload documents and sign forms from their smartphone in real time.

Plaid is an open banking data network that allows apps to connect to users’ bank accounts (with permission) to pull financial data. In auto lending, Plaid is used to instantly verify borrower information such as income and assets by analyzing bank transactions. Plaid’s tools (e.g., Plaid Income and Assets) let lenders replace manual document upload with API calls that retrieve salary deposits, account balances, and transaction histories securely from thousands of financial institutions. This streamlines underwriting and reduces fraud – resulting in faster, more accurate loan decisions. Major lenders also use Plaid to verify loan payoff amounts when refinancing and to monitor borrower cash flow for collection insights.

A branded mobile flow that guides borrowers through submitting stips in minutes. Mobile friendly, sent via a link to their cell by dealers or call center reps. Handles uploads, questions, and status tracking. Integrated with your LOS and optimized for completion, not confusion. Built to reduce friction, cut cycle times, and get more deals funded without follow-up.

Explore our custom built Auto Finance solutions →Core System Connectors

For banks and credit unions, core system connectors integrate lending platforms with core banking systems, enabling real-time balance checks, account data sharing, disbursement, and servicing coordination. These API connectors are vital for credit unions, banks, and fintech lenders operating within regulated cores. These tools accelerate integration timelines, reduce vendor lock-in, and enable modular platform modernization. They are critical to delivering real-time decisioning, funding, and account-level visibility without reengineering the entire tech stack. Although many market as pre-integrated, it’s important to note that since most cores are configured uniquely, there is often still a substantial implementation required.

Kinective (formerly NXTsoft Omniconnect) is an API integration platform that bridges fintech applications and financial institutions’ core systems. In auto finance, OmniConnect securely transfers data between loan origination/servicing software and bank or credit union cores, eliminating manual re-entry. It comes with pre-built connectors for major core providers and can be deployed quickly, enabling real-time updates (e.g., booking a funded auto loan into the core within seconds). NXTsoft boasts connectivity to 99% of U.S. banking cores, greatly reducing integration timelines.

PortX is an integration platform tailored to community banks and credit unions, offering an open banking API layer on top of core systems. For auto lenders, PortX can expose core banking functions (like loan data retrieval, payments posting) via modern APIs, making it easier to connect with dealer software, mobile apps, or third-party services. It includes an “Integration Manager” that manages these connections and scales with cloud infrastructure. By using PortX, a lender can avoid building custom core interfaces for each new service. For example, if an auto lender wants to use a new AI underwriting tool, PortX’s universal core API can plug it in quickly. This reduces dependency on legacy core providers and supports real-time data exchange, which is crucial for offering instant decisions and up-to-date loan information to customers.

Janusea, a newcomer in the integration space for auto-finance, provides a core integration translation layer designed to connect credit union and community bank cores with fintech solutions. With one integration to Janusea, an auto lender gains access to multiple core systems. Janusea’s platform is hosted and secure, handling the complexity of different core protocols and data formats. This allows auto finance fintechs or smaller lenders to implement modern solutions (CRM, analytics, online lending portals) without custom-building integrations for each core. Janusea is backed by credit union industry expertise.

Chatbots and Virtual Agents

Chatbots and virtual agents support borrower self-service, lead capture, and operational efficiency by handling routine questions, status updates, and document submission through conversational interfaces. For lenders, these tools reduce call center volume, shorten application cycles, and support 24/7 borrower engagement. AI-powered bots can also assist in collections, onboarding, and stipulation gathering. Integration with servicing platforms, CRM, and compliance workflows is essential for operational continuity and audit readiness.

Kasisto (creator of the KAI conversational AI platform) provides advanced chatbots for banking and finance. In auto lending, Kasisto’s virtual agent can handle customer inquiries via chat or voice – for example, answering questions about loan payoff amounts, due dates, or assisting with loan applications. It understands natural language and provides human-like responses, integrated with core systems to fetch account details. Used by banks like TD and credit unions, Kasisto’s tech is known for domain expertise in financial conversations. For an auto lender, this means the bot can recognize phrases like “What’s my remaining balance?” or “I need to defer a payment” and execute or route the request appropriately. This reduces call center volume and improves customer satisfaction with round-the-clock service.

Intercom is a customer messaging platform that many auto finance companies use on their websites and apps. It enables live chat with support agents as well as automated chatbots for common queries. Through Intercom, prospective borrowers can get quick answers (e.g., “How do I apply for an auto loan?”) and existing customers can resolve simple issues (like requesting a payoff quote) in a chat interface. Highly user-friendly and easily customizable. Auto lenders often deploy Intercom’s bot to greet users on the online portal and direct them to self-service articles or collect information before handing off to a loan servicing agent.

LivePerson provides an AI-powered messaging platform used by large enterprises for customer service. In auto finance, LivePerson can unify conversations across SMS, web chat, and social media, allowing borrowers to communicate on their channel of choice. Its AI can handle many interactions: verifying identity, taking a payment, or scheduling a call, all through conversational prompts. Complex issues seamlessly escalate to live agents with full context.

CRM and Marketing Platforms

CRM and marketing platforms centralize borrower engagement, lead tracking, and campaign execution across direct and indirect lending channels. They provide a unified view of borrower interactions, automate lifecycle messaging, and support sales alignment in dealership or call center environments. These platforms are foundational for managing dealer relationships, borrower onboarding, and re-engagement. In the age of embedded and digital lending, CRM tools support more personalized, data-driven borrower journeys.

Salesforce Automotive Cloud is a CRM platform tailored to the automotive industry (including auto finance). It gives lenders a 360° view of customers and their vehicles, enabling personalized communication and proactive service. Lenders can track loan accounts, send automated reminders, and integrate lead data from dealerships, all within Salesforce’s AI-driven, cloud-based system.

Microsoft’s Dynamics 365 CRM, often used in banking, can be configured for auto lending customer management. It provides tools for contact management, case handling, and workflow automation integrated with Office 365. Lenders can use Dynamics to manage dealer relationships, track customer interactions, and analyze data with Power BI.

HubSpot offers an all-in-one CRM and marketing platform popular with mid-sized financial firms due to its quick deployment and lower cost. Auto lenders can use HubSpot to manage leads (e.g., from online applications), automate marketing campaigns to borrowers (email/SMS), and handle customer service tickets. Its user-friendly interface and strong email automation help engage borrowers throughout the loan life cycle. Emphasizes inbound marketing and content (which can aid loyalty/refi campaigns).

Adobe Experience Cloud provides digital customer experience and marketing tools that auto lenders can use for engagement. It includes analytics, personalized content delivery, and campaign orchestration. For example, lenders can use Adobe to send targeted offers (refinance, trade-up) based on customer data and to ensure consistent messaging across web, email, and mobile. Adobe’s automotive solutions help create one-to-one personalized interactions at scale. Used more by OEMs and large captives to manage brand experience, but lenders with direct consumer business (or large portfolios) leverage it for customer retention and upsell (e.g., insurance or service contracts). Typically requires significant marketing team involvement.

CRMNEXT is a CRM platform designed for banks and credit unions to manage customer relationships and marketing. In auto finance, CRMNEXT helps lenders track leads (from dealers or online), automate follow-ups, and coordinate between sales and underwriting. It offers industry-specific workflows – for instance, creating tasks for loan officers to follow up on approved-but-unfunded applications or cross-sell to existing loan customers. Used by several large credit unions and captive auto lenders, CRMNEXT is known for its “AutoFlow™” technology to simplify loan processes. It unifies data from multiple sources (loan origination, core, contact center) into one view, so reps can see the full picture of a borrower. Marketing teams leverage it for campaigns – e.g., identifying auto loan customers with high rates and generating refinance offers.

Payments

Payment technology providers support loan repayment, recurring billing, payoff processing, and borrower-facing payment interfaces. For auto lenders, especially those managing large portfolios or subprime accounts, payment platforms reduce friction and support a range of channels: ACH, card, cash networks, mobile wallets, and IVR. These tools also support compliance with real-time payment authorization rules, fee handling, and grace period policies. Integration into servicing systems is critical to ensure up-to-date account status, accurate reconciliations, and borrower notifications.

Paymentus provides a next-generation electronic bill payment platform. It enables auto lenders to offer modern loan payment options across web, mobile, IVR, text, etc. Paymentus supports credit/debit card, ACH, digital wallets, and even real-time payments, all through an integrated solution. Also offers an “Instant Payment Network” connecting to PayPal, Venmo, etc., catering to younger borrowers’ preferences. By improving the user experience for loan payments, it drives more on-time payments and higher borrower satisfaction.

ACI Speedpay (Formerly Western Union Speedpay) is an electronic bill payment platform widely used in consumer finance. It allows auto lenders to present bills and collect payments via multiple channels (online portal, mobile app, phone IVR, etc.). Speedpay supports one-time and recurring payments via ACH or cards, and even cash via walk-in locations. Many large auto lenders (captive and banks) have used Speedpay for decades as it’s often integrated into lenders’ servicing systems. ACI has been enhancing it with real-time payments and mobile wallet capabilities to keep up with fintech competitors.

PayNearMe is a payments platform that specializes in facilitating cash and electronic payments for lenders. It allows auto loan borrowers to pay with cash at 60,000+ retail locations (7-Eleven, CVS, etc.) by scanning a PayNearMe barcode – which is vital for the underbanked customer segment. Additionally, PayNearMe supports debit, ACH, and mobile-first methods (Apple Pay, Google Pay, PayPal, Venmo, etc.) in one platform. This breadth of options helps lenders collect more on-time payments by catering to every preference. Used heavily in subprime and buy-here-pay-here auto finance, where cash payments are common. Also popular for its SMS payment reminders with one-click pay links.

REPAY offers an integrated, omnichannel payments platform tailored for auto finance and other industries. With REPAY, auto lenders can accept loan payments via online portal, mobile app, text-to-pay, phone, or in-person – all in one system. REPAY’s platform supports card, ACH, and even outbound ACH for disbursements. In 2022, REPAY acquired Payix, a borrower-facing mobile app and texting solutions for collections that allows borrowers to see loan details and make payments or communicate with the lender – improving self-service. This enhanced REPAY’s offerings to include white-label mobile apps and two-way texting for payments and collections. Popular with independent auto finance companies, REPAY offers integrations into most major LMS platforms.

MoneyGram’s ExpressPayment service allows auto loan borrowers to make cash payments on their loans at MoneyGram locations (e.g., Walmart, 7-Eleven). The payment is transmitted in near-real-time to the lender’s account. This gives customers a convenient, in-person option to pay on loans and avoid default, especially useful for those without bank accounts or who prefer cash. Often used by subprime auto finance companies and buy-here-pay-here dealers to broaden payment channels. It reduces mail-in money orders and can prevent late fees by posting same-day. (Borrowers may pay a fee to MoneyGram for the service.)

PaymentVision is a payment processing gateway tailored to the consumer finance industry. Auto lenders use it to accept loan payments across multiple channels: online web portal, mobile app, IVR phone system, or via live agents. It supports ACH, debit/credit cards, and checks, with compliance features like PCI-certified tokenization and customizable payment schedules. Many auto loan servicers integrate PaymentVision to provide borrowers with self-service payment options 24/7 (for example, a borrower can call an automated line at midnight to make a payment). It also handles recurring payments and can send reminders. By consolidating all payment types in one system, it simplifies reconciliation for lenders and offers consistent reporting.

AutoPayPlus (offered by US Equity Advantage) is a service that automates loan payments in alignment with the borrower’s pay cycle. Commonly used for biweekly payment plans, it debits half-payments every two weeks, resulting in 26 half-payments per year (13 full payments). This accelerates payoff of the auto loan, saving interest for the borrower and reducing risk for the lender.

Vehicle Valuation Providers

Vehicle valuation tools provide auto lenders with the market data needed to assess collateral risk at origination, monitor asset value over time, and support downstream recovery strategies. These platforms use VIN-specific attributes, auction trends, and retail data to determine real-time loan-to-value ratios. For lenders funding used vehicles, working with independent dealers, or managing lease portfolios, valuation data is a critical input to underwriting, pricing, and risk controls. These tools often integrate directly into LOS, decisioning engines, and repossession workflows to ensure collateral risk is consistently factored into key decisions.

Car Valuation and Automotive Market Data

Vehicle valuation platforms provide lenders with current and historical market data to calculate loan-to-value (LTV) and support pricing, underwriting, and recovery strategies. These tools use auction trends, retail pricing, depreciation curves, and VIN-specific attributes. For auto lenders, especially those funding used vehicles or working with independent dealers, real-time vehicle values are essential to prevent over-advancing and protect recovery margins. Integration into LOS and repossession platforms ensures valuations are applied consistently across origination and servicing.

Kelley Blue Book (part of Cox Automotive) provides well-known vehicle valuation guides for new and used cars. KBB Values (e.g., Trade-In Value, Lending Value) are benchmarks that many auto lenders use to assess collateral value and loan-to-value (LTV) ratios. KBB’s Lending Value is specifically designed for wholesale lenders and factors in auction trends plus reconditioning costs. Lenders access KBB data via web tools or integrated services to ensure they aren’t over-loaning on a vehicle (KBB values update weekly). Lenders typically use KBB for passenger vehicles though KBB also offers valuations for motorcycles, RVs, etc.

Black Book provides real-time wholesale vehicle values based on auction data. It’s focused on helping dealers and lenders reduce risk with precise, up-to-date market values. Black Book’s data (auction wholesale, trade-in, retail) is widely used in auto finance for calculating LTV and residuals (Black Book values update daily). Many lenders consider Black Book “the gold standard” for current auction values, especially for used car collateral.

J.D. Power (which acquired NADA Used Car Guides) provides vehicle valuation data used by lenders for underwriting and portfolio management. The J.D. Power Values (formerly NADA book values) include trade-in, loan, and retail values for used vehicles and are updated monthly. Lenders often refer to the NADA “Loan Value” – a conservative value used to set maximum loan amounts. J.D. Power’s values are based on millions of transactions and are accessible through its online portal for lenders.

Edmunds offers consumer-facing car valuations (Edmunds True Market Value®) which estimate the market price of used vehicles. While primarily aimed at consumers, some lenders and dealers reference Edmunds for a retail market perspective (especially for exotic/older models where KBB/NADA have limited data). Edmunds aggregates listing data and dealer sales info to give regionalized values for vehicles in various conditions.

MMR is a benchmark pricing tool from Manheim (Cox Automotive) that provides the latest wholesale auction values for vehicles. It aggregates millions of auction transactions to give auto lenders an expected auction sale price for a vehicle based on make, model, year, mileage, condition, and region (MMR values are updated daily). Lenders use MMR to assess collateral value during underwriting and when determining recovery value on repossessions. When remarketing, knowing a car’s MMR helps in decision-making (e.g., whether to send to auction immediately or hold). Manheim also provides a Used Vehicle Value Index, which lenders follow to understand broader market trends.

Galves is a vehicle valuation guide known for accurate trade-in and wholesale values, particularly in the Northeast U.S. market. It publishes weekly pricing data that reflects what dealers are paying for cars at auctions and on trade. Auto lenders and dealers use Galves to double-check vehicle values – some lenders accept Galves for collateral valuation in addition to or instead of MMR, especially for older or less common vehicles. Galves has a reputation among dealers as a realistic gauge of “actual cash value” for trades.

Vehicle History and Condition Data

Vehicle history data providers deliver VIN-level insights including prior ownership, accidents, title issues, and odometer anomalies. For auto lenders, especially in used and refinance scenarios, this data supports fraud prevention and residual risk analysis. Condition insights help flag high-risk collateral that might not be evident from credit data alone. Many LOS platforms include direct integrations to pull history reports automatically during underwriting, providing an additional layer of asset-level risk assessment.

CARFAX provides detailed vehicle history reports based on a vast database of title records, accident reports, service history, odometer readings, and more. Auto lenders use CARFAX to identify any red flags on a vehicle that a borrower is using as collateral – such as salvage or rebuilt title, prior total loss, chronic odometer inconsistencies, or deployment as a fleet or rental. Knowing a car’s history helps lenders adjust LTV or decline loans on problematic vehicles. Many indirect lenders require a CARFAX report as part of funding a dealer-originated loan. A clean CARFAX gives confidence in collateral value, whereas a report showing, say, a frame damage accident or flood title may lead the lender to reduce the loan amount or refuse the vehicle. CARFAX’s name recognition also provides transparency: some lenders give the report to consumers too, to educate them on their car’s history.

AutoCheck is Experian’s vehicle history report service, which similarly tracks title brands, auction announcements, accidents, and other vehicle events. It is known for its AutoCheck Score – a numeric score that summarizes the vehicle’s history compared to similar vehicles. Lenders often accept AutoCheck in lieu of CARFAX, as it may have additional auction data and patent-pending accident detection algorithms. Using AutoCheck, lenders verify the collateral has no hidden issues before approving the loan. AutoCheck is heavily used in the auction industry (Manheim listings include AutoCheck reports). For lenders, one advantage is batch processing and integration with Experian’s systems – an auto lender pulling an Experian credit report can simultaneously request an AutoCheck on the vehicle. This one-stop approach speeds up underwriting on used cars. If discrepancies arise (e.g., AutoCheck reveals a different number of owners than the dealer stated), lenders can investigate further or adjust loan terms.

Title and Registration Platforms

Title management solutions handle lien placement, title perfection, electronic lien and title (ELT) programs, and registration services. These tools reduce manual DMV processes and help lenders stay compliant with lien accuracy and timing requirements. For lenders funding large volumes of indirect loans, or managing refinance workflows across multiple states, these platforms centralize title visibility and streamline post-booking processes. Integration with servicing platforms enables proactive follow-up on title exceptions and release automation.

Wolters Kluwer Lien Solutions offers technology for managing vehicle titling and lien perfection. Its platform helps auto lenders file and track liens on vehicle titles across all U.S. states, including electronic lien and title (ELT) where supported. Lenders use it to ensure their security interest is properly recorded with DMVs and to automate lien releases when loans are paid off.

DDI Technology offers the Premier eTitleLien® system – a web-based electronic lien and title solution used by nearly 3,000 lenders nationwide. DDI’s platform allows lienholders to electronically record liens and receive titles from state DMVs, eliminating paper titles. It provides real-time title status tracking and lien release processing, significantly lowering operating costs for lenders. DDI is an approved ELT provider in almost every state with an ELT program. Highly popular with credit unions and regional banks for its ease of use.

PDP Group is a long-time provider of title administration services for auto finance. Its SimplyELT program streamlines electronic lien and title processes – reducing paper, enhancing fraud protection, and speeding up title processing for lenders. PDP is an approved ELT vendor in all states where ELT is offered. Services include end-to-end title management: from lien placement at funding to lien release, title remarketing, and insurance tracking. Known for handling high volumes for large national auto lenders and captives.

CHAMP Titles provides a fully digital vehicle title and registration platform. Its technology enables state DMVs and lenders to move from paper-based titles to electronic, reducing processing time and fraud. For example, CHAMP is the exclusive ELT provider for New Jersey as it modernizes to digital titles. Uses a pay-for-performance model with state agencies, which is unique in the industry. CHAMP’s platform has processed millions of title transactions, demonstrating faster lien releases, cost savings, and enhanced security through blockchain-like validation.

Dealertrack’s Collateral Management Services (formerly VINtek) provide electronic lien and title management for auto lenders. They help lenders manage titles digitally across all 50 states, reducing paperwork and speeding lien release. Dealertrack is an approved ELT vendor in states nationwide, enabling electronic exchange of lien data with DMVs. One of the largest ELT providers, integrated with Dealertrack’s loan servicing solutions. Often the go-to for banks, credit unions, and captive finance companies to handle titles.

Vitu (by MVSC) offers electronic title and registration solutions in multiple states. It provides dealerships and lenders with online portals to handle vehicle registration, title transfers, and ELT. Vitu is an approved ELT service provider in 50 states. By digitizing registration and title processes, Vitu helps lenders perfect liens more quickly and dealers complete title work without visiting the DMV. Strong presence in states like California (original DMVdesk service), Illinois, and Florida. Often more dealer-facing for reg, but also supports lender ELT needs.

Insurance Tracking and Force-Placed Insurance Tools

These platforms monitor borrower insurance coverage and support compliant placement of collateral protection insurance (CPI) or vendor single interest (VSI) policies. Auto lenders use these tools to detect lapses in coverage, trigger borrower outreach, and administer force-placed insurance when needed. Proper tracking helps protect asset value while ensuring adherence to loan terms and regulatory expectations. For subprime and near-prime portfolios, CPI programs also support loss mitigation and revenue recovery.

Allied Solutions provides collateral protection insurance (CPI) programs and insurance tracking services to auto lenders (especially many credit unions and regional banks). They handle the monitoring of borrowers’ auto insurance policies to ensure continuous coverage. If a borrower’s insurance lapses or is insufficient, Allied can issue a force-placed insurance policy to protect the vehicle and lender’s interest, adding the premium to the loan. Allied manages the end-to-end process: sending notices to borrowers about missing insurance, giving grace periods per regulations, and ultimately placing CPI coverage if needed. This outsourcing frees lenders from tedious tracking and mitigates uninsured loss risk. Allied also often provides other products (GAP, service contracts), but in the CPI arena, they are known for responsive service and custom lender portals that give transparency into insurance status across the portfolio.

State National specializes in lender-placed auto insurance and tracking, and is one of the industry’s longest-standing providers. Their CPI solution monitors borrowers’ insurance in real time and automatically issues a policy when coverage cannot be verified. State National’s technology integrates with loan servicing systems to receive insurance updates and send out required notices. Once force-placed coverage is active, they handle claims on behalf of the lender if the vehicle is damaged. Many large auto finance companies partner with State National for their reliability and balance sheet strength (backed by Markel Corporation). State National’s tracking system has a high verification rate – they often can confirm a borrower’s new policy through data links with insurers, avoiding unnecessary placements. When CPI is placed, their team ensures compliance with state laws (which often dictate notification timing and refunding any overlap if borrower reinstates coverage). This helps lenders avoid regulatory pitfalls while safeguarding collateral.

Collections Management Systems

Collections platforms help auto lenders manage delinquency workflows, automate account prioritization, and track agent activity. These tools provide queue management, contact scripting, compliance tracking, and integration with dialers or outbound messaging tools. For lenders managing high-volume subprime portfolios or indirect loans, a purpose-built collections system improves efficiency, standardizes treatment, and supports portfolio segmentation. Integration with servicing platforms ensures real-time account data flows across collections and loss mitigation teams.

Katabat provides a digital collections platform that helps auto lenders engage delinquent borrowers through omnichannel communications. It automates collections workflows – sending personalized SMS, emails, and portal messages to past-due customers with payment options or payment plan offers. Katabat’s system uses analytics to prioritize accounts and can negotiate settlements or promise-to-pay arrangements digitally, reserving agent involvement for complex cases. Lenders adopting Katabat have seen increases in cure rates as borrowers find it easier to respond at their convenience (e.g., clicking a link to pay half now and schedule the rest, instead of dodging calls). The platform also enforces compliance (all messages use pre-approved content that meets FDCPA and UDAAP standards).

C&R Software’s platform (built on what was once FICO’s Debt Manager) is an enterprise-grade collections and recovery system. It offers comprehensive case management for delinquent loans, allowing auto lenders to configure treatment strategies based on risk scores or customer segments. It manages all stages – early delinquency, loss mitigation (extensions, due date changes), repossession initiation, and post-charge-off recovery or sale of debt. Many large banks and captives use this platform because of its robustness. Collectors work through queues with next-best-action prompts, and managers can easily adjust strategies (for example, automatically route high-risk accounts to skip-tracing after 30 days, or send lower-balance accounts straight to an automated letter series). The system also logs every contact attempt and outcome, aiding in compliance and performance analytics.

CARM-Pro (Collect, Account, Recover, Manage) is a collections management system popular with community banks and credit unions for handling delinquent loans. For auto finance, it centralizes delinquency tracking, generates collection notices, and schedules follow-up actions for collectors. CARM-Pro features promise tracking, so if a borrower promises to make a payment by a certain date, the system will remind the collector to verify or reschedule if not received. Favored for its ease of use, CARM-Pro integrates with core banking systems to pull loan data and update balances after payments. It supports all loan types, but auto loans benefit from its repossession and remarketing modules (it can prompt users to initiate repo after certain delinquency criteria and then track recovered vehicle details). CARM-Pro also produces management reports on collections effectiveness – e.g., cure rate by collector or by delinquency bucket – which smaller institutions use to improve their processes.

HighRadius offers an AI-driven receivables and collections platform, historically used in corporate finance, but its RadiusOne and related solutions can apply to consumer lenders as well. In auto finance, HighRadius can automate dunning (reminder emails/texts for payments), prioritize collections efforts using AI predictions (which accounts are likeliest to pay vs. roll to charge-off), and streamline payment processing by integrating online payment portals for past-due accounts. Though more commonly seen in enterprise AR, some large auto lenders have experimented with HighRadius to enhance their consumer collections. Its AI models analyze payment behavior and external data to forecast default risk, so collectors can focus on the most critical accounts. It also excels in dispute management – if a borrower contests a late fee or balance, HighRadius can log and route that for resolution. By automating routine tasks (like sending out daily payment reminders or updating balances), it frees collectors to handle nuanced cases. Over time, its machine learning could potentially adapt strategies (e.g., suggesting a custom payment plan that has worked for similar customers).

Repossession and Remarketing Tech

Repossession and remarketing platforms help auto lenders recover, track, and liquidate vehicles tied to delinquent or defaulted loans. For lenders serving subprime, BHPH, or indirect portfolios, these tools reduce recovery cycle times, improve transparency with third-party agents, and optimize liquidation value. Deep integration into servicing and collections platforms helps automate repo triggers, track recovery status, and seamlessly transition assets into remarketing pipelines.

This category includes:

- Repo management platforms

- Vehicle telemetry tools

- Auction remarketing services

Repo Management Platforms

Repossession platforms connect lenders with recovery agents, manage assignments, track vehicle location, and facilitate post-recovery status updates. These systems reduce time-to-repo, centralize communication, and support compliance with state-specific notice and documentation rules. For lenders managing large indirect portfolios or subprime accounts, automated repo management helps reduce losses, improve transparency, and maintain better control over third-party agent networks.

Clearplan is a software platform that modernizes the day-to-day management of repossession assignments. It provides a real-time dashboard for lenders and repossession agencies to communicate. Lenders upload cases (with vehicle info, borrower address, etc.), and repo agents in the field use the Clearplan mobile app for route planning and status updates (e.g., “out for pickup”, “vehicle recovered”). The system also maps agent coverage and uses GPS to optimize efficient recovery routes. Clearplan brings transparency to the traditionally opaque repo process. Lenders can log in and see which accounts are actively being worked and any notes from agents (like “address given is a vacant lot”). It also timestamps all actions, creating an audit trail that can be useful if there are disputes or compliance questions.

RDN is a widely-used repossession assignment and management network that connects auto lenders with a large network of certified repossession companies. Lenders input defaulted loan accounts into RDN, which then distributes assignments to repo agents nationwide. Throughout the process, RDN provides status updates, condition reports when the vehicle is found, and final recovery details. It also handles compliance documentation, like confirming agents are licensed and insured.

Remarketing Services

Remarketing providers support post-repo or lease-return vehicle sales via auction or direct channels. These platforms provide vehicle inspection, transport, digital listing, and auction management tools to help lenders recover the highest possible resale value. For lenders with repossession or lease portfolios, strong remarketing partners help reduce holding time, prevent value erosion, and optimize recovery rates. Integration with repossession and servicing systems ensures smooth transition from recovery to resale.

ADESA is a major vehicle auction company (now owned by Carvana in the US) with both physical locations across North America and robust digital auction platforms. Auto lenders utilize ADESA to dispose of repossessed vehicles and off-lease returns, aiming to get the best resale prices. ADESA provides end-to-end remarketing: condition inspections, reconditioning services, auction sales (live and online), and settlement. Lenders can set reserve prices or sell with arbitration policies to protect against undisclosed issues. Many auto finance firms have ADESA representatives who help strategize optimal sale timing (e.g., sending convertibles to auction in spring for higher demand). ADESA’s auction data and market reports also guide lenders on residual value trends. The service includes optional extras like “dealer-only” sales for better control or heavy upstreaming (trying to sell to dealers online before a car reaches the physical auction).

Manheim (part of Cox Automotive) is the largest auto auction network in the U.S. It offers a wide array of remarketing channels – from traditional in-lane auctions to simulcast online bidding to the Manheim Express app for off-site dealer purchases. Auto lenders heavily rely on Manheim to liquidate repossessions quickly and efficiently. Manheim provides detailed condition reports via Auto Grade, and runs specialty sales (e.g., highline luxury, salvage) to target the right buyers for each vehicle. Lenders often achieve strong recovery values through Manheim due to its huge buyer base. Additionally, Cox Automotive’s ecosystem (which includes Kelley Blue Book, MMR, and Ready Logistics for transportation) means lenders can get a full suite of services: from valuation to auction to delivery of the sold unit.

Vehicle Telemetry

Vehicle telemetry tools use GPS or connected car data to support real-time tracking, payment reminders, starter interrupt, and recovery enablement. These tools are often deployed in subprime, BHPH, or lease-to-own contexts where asset control and location are critical. Telemetry data can also help detect tampering, unauthorized use, or geographic risk factors. Lenders using these tools must ensure regulatory compliance and integrate with collections and repo workflows for maximum effectiveness.

PassTime provides GPS tracking and starter-interrupt devices commonly used in subprime auto lending and buy-here-pay-here financing. Installed in a vehicle at origination, the device allows the lender to monitor the car’s location and, in cases of severe delinquency, remotely disable the starter (preventing the car from being started until the borrower makes payment or contacts the lender). PassTime’s system includes an online portal for real-time tracking, geo-fencing, and automated reminder beeps from the device as payment due dates approach. Lenders report significant reductions in losses with these devices.

Solera (Formerly Spireon) is a GPS telematics solution designed for vehicle finance, enabling lenders to track collateral and manage risk. Through an easy-to-use dashboard, lenders can see their entire fleet of financed vehicles on a map, set up geo-zones (alerting if a vehicle leaves a certain area, which could indicate skip), and get battery health alerts. GoldStar units can also include starter-disable capability. Solera Spireon provides robust analytics like drive time and location history, which can help in locating hard-to-find skips. One of the largest providers of automotive telematics. Beyond just tracking, they emphasize portfolio analytics – for example, highlighting if many accounts are clustering in high-risk areas. Lenders using GoldStar often integrate it with their loan management systems, so that when a loan is paid off, a signal can be sent to stop tracking or remove the device.

Compliance, Fraud, and Risk Management

This category includes technology that supports regulatory compliance, fraud detection, identity verification, and risk controls across the auto lending lifecycle. These tools automate KYC checks, monitor for suspicious behavior, validate document authenticity, and apply rules aligned to federal and state lending laws. For lenders operating across jurisdictions or through third-party dealer channels, this stack ensures consistent policy enforcement and reduces exposure to fines, fraud, and reputational damage. Integration with LOS, CRM, and servicing systems ensures compliance and risk controls are embedded across borrower and dealer touchpoints.

Identity Verification / KYC

Identity verification tools help lenders confirm applicant identity, flag fraudulent profiles, and comply with KYC/AML requirements. These tools include document scans, facial recognition, database matching, and behavioral analytics. For auto lenders, especially those accepting digital or indirect applications, identity tools reduce fraud risk and support onboarding at scale. Integration into LOS or decisioning flows ensures minimal borrower friction while satisfying compliance needs across channels.

Alloy provides an end-to-end identity and fraud decisioning platform that helps banks, credit unions, and fintechs automate KYC/KYB verifications and manage fraud checks via a single API. Alloy’s platform aggregates 170+ data sources to create a unified view of an applicant, enabling lenders to make real-time identity, credit, and compliance decisions. Popular among fintech lenders for onboarding. Helps auto lenders with an all-in-one solution to check identity, income, and other risk signals in one workflow.

Socure is a leading digital identity verification and fraud prevention platform. It uses AI/ML and hundreds of data sources (email, phone, address, device, etc.) to verify consumer identities in real time. Auto lenders leverage Socure to instantly confirm applicant identity and reduce synthetic identity and ID fraud, improving online loan application security. Major clients across banking and fintech. Recognized for high accuracy in KYC (Know Your Customer) and reducing false positives in fraud screening.

Jumio provides online identity verification services using AI – primarily through ID document scanning and biometric facial recognition. In an auto loan process, Jumio can prompt the applicant to capture a photo of their driver’s license (or other ID) and a selfie. It then verifies the ID’s authenticity (holograms, text, photo) and matches the selfie to the ID photo to confirm the person’s identity. This KYC step helps lenders ensure the borrower is real and actually who they claim to be, preventing identity theft or loan fraud. Particularly critical for remote lending or high-risk applicants. A lender might trigger Jumio for, say, applicants with thin credit files or if other fraud flags arose. Jumio’s process is usually completed in under a minute, providing a clear “verified” or “unverified” result. It also cross-checks against known watchlists.

Point Predictive provides AI-based risk management solutions for lending markets like auto. Its fraud scoring solutions use machine learning models to detect misrepresentation or fraud in loan applications with low false positives. For auto lenders, Point Predictive’s Auto Fraud Manager and income validation tools help identify high-risk applications (e.g. fake employer, inflated income) to prevent early defaults and fraud losses. Widely used by auto finance companies to combat application fraud (e.g. synthetic identities, straw buyers). Publishes an annual Auto Lending Fraud Trends report quantifying industry fraud risk.

Document Verification, and eVault