Loans originated and

serviced by Praxent clients

COMMERCIAL LENDING CONSULTING AND LENDING TECHNOLOGY

Commercial Lending

That’s Truly Limitless.

We help commercial lenders launch faster,

lend smarter, and lead the market.

Our Expertise

Small Business and SBA Lending

Equipment and Vendor Financing and Leasing

Invoice Factoring and Supply Chain Finance

Working Capital Financing

Merchant Cash Advance (MCA)

Franchise Financing

Asset-Backed Finance

Embedded Finance

Your lending platform

is costing you customers.

Business borrowers expect speed, simplicity, and self-service.

Dated experiences and slow systems lead to lost revenue. Get real-time underwriting, faster funding, fewer drop-offs, and a platform that flexes to your lending strategy with Praxent.

COMMERCIAL LENDING SPECIALISTS

We create market leaders.

SBA Lender digital platform

created by us

SMB data integrations

Will you be next?

Lending platforms built to fund faster.

From asset-backed finance to SBA lending, our team combines lending expertise with proven technology to speed approvals and simplify operations.

Get flexible, data-driven systems that adapt to any business lending specialty so you can fund more loans and lead the market.

Book an expert digital lending consultationLoan Origination System Modernization

Drive higher application completion rates and faster approvals through streamlined lending journeys with real-time application status updates for borrowers.

Real-Time Underwriting Data Collection

Seamless connections to credit bureaus, bank data, accounting platforms, IRS systems, and verification services with data standardization and automated pipelines.

AI-Powered Underwriting Automation

Streamline and automate key underwriting functions, such as risk assessment and document standardization, with custom AI solutions.

Self-Service Borrower Portal Development

Deliver self-service capabilities that decrease support costs and reduce missed payments while improving customer satisfaction.

Embedded Lending

Generate referrals and new revenue streams by embedding credit options inside accounting, POS, and BaaS platforms.

Built-In Compliance Management

Gain real-time insights into conversion rates, approval times, and operational efficiency.

Performance Analytics & Reporting

Integrated KYC, AML, and regulatory reporting tools that scale with your loan volume.

API-First Modular Lending Architecture

Flexible platform foundations that adapt and scale to new requirements, integrate with fintech partners, and support updates without disrupting operations.

Get more business borrowers to the finish line sooner.

Transform their digital lending flows with our proven approach. Leading commercial and SMB lenders trust us to reduce drop-off, simplify processes, and speed up time to fund.

Our experts use insights from real user behavior to deliver platforms that cut application friction, automate document intake, and get programs up and running faster.

OUR WORK

Client Wins

Faster SBA funding than industry average

Reduction in application length for SMB LOS platform

More throughput in commercial underwriting with AI

Fewer underwriting tasks for commercial lending platform

Decrease in customer service emails for SMB lender

Bryan Hallene

COO, NEWITY

Praxent was, from day one, the provider that truly understood our business and what we were trying to accomplish. They researched our business, asked specific business-related questions, and quickly evidenced their ability to add value beyond the tech build. They’re very knowledgeable about the space and understood the depth and breadth of our project. From our perspective, we couldn’t have asked for a better partner – Praxent was the right choice for us.

Cut funding time and drive more conversions.

Smart platforms power faster decisions, fewer errors, and flows built for how your borrowers actually work.

→ Better borrower experiences

→ Faster loan processing

→ Automated workflows

The outcomes are what define your lending platform. Be known as a market leader.

Rebuild underwriting with AI-driven accuracy.

Reinvent your underwriting system with AI at its core. Short-cut underwriter decision time while improving accuracy with AI tools that extract and process unstructured data, flag fraud patterns, and route exceptions for human review only when needed.

Your lending team reduces their manual workload while enjoying quicker approvals and the confidence that comes from data-driven credit decisions that scale with your business.

Scale your lending without scaling costs.

Develop a more efficient lending flow.

Praxent maps your end-to-end business logic, captures real exceptions, and redesigns processes to reduce friction for borrowers and underwriters. Your teams move faster, serve more customers, and stay compliant.

Build real-time integrations and flexible systems.

Commercial lending demands flexible connections to credit bureaus, KYC providers, fraud engines, and banking APIs to deliver instant decisions.

We build API architecture that allows flexibility and scales as you need it. You can add new data sources and launch products without rebuilding your core system. Your platform stays flexible, your operations stay fast, and your borrowers get funded.

OUR SERVICES

Partner with us

UX/UI Redesign

From intake to servicing, we identify where borrowers drop off and workflows fail. Then we design interfaces that work harder, win deals, and keep borrowers engaged from first click through funding.

System Modernization

Fix what’s slowing you down. Replace brittle code with modular builds, secured pipelines, real-time integrations, and cloud-ready lending systems that scale with certainty.

API Integrations

Connect to credit, fraud, IRS, and KYC tools through real-time, secure, scalable APIs that reduce delays, support compliance, and deliver with confidence.

Underwriting Process Re-Engineering

From manual checks to missed steps to mismatched systems, underwriting should not feel broken. We capture exceptions, map logic, align teams, rework flows, and deliver efficient underwriting systems so your platform runs leaner and funds faster.

Application

Development

Build and extend LOS, underwriting, and servicing platforms using proven expertise, modern frameworks, and sprint discipline. Drive faster launches without sacrificing stability.

DevOps and

DevEx

Move testing, security, and reviews sooner in the cycle to catch errors early. We then build pipelines so you can ship faster, scale reliably, support audits, and maintain compliance without slowing down delivery.

Modular Architecture

Decouple legacy logic through domain-driven design. Deploy modular lending systems that release faster, scale cleanly, and let you adapt without rebuilding your entire platform.

Cloud Development

Stay reliably available at scale while reducing overhead, maintaining compliance, and moving faster with a modern infrastructure built for hybrid and cloud.

Data Centralization

Break down silos and turn disconnected data into unified intelligence. Align teams, automate reporting, surface insights, streamline underwriting, improve decisions, and unlock better borrower experiences at scale.

AI Development

Implement AI within SOC II compliant frameworks. Automate underwriting, reduce manual review, and shrink time-to-fund without disrupting trusted workflows.

JUMPSTART YOUR PROJECT

Speak to our lendtech experts.

SPECIALIZED EXPERTISE IN COMMERCIAL LENDING PLATFORM MODERNIZATION

The Praxent Difference.

Our commitment to quality goes far beyond technology. We’re not a global consulting conglomerate; we’re a boutique team of experts in lending technology.

× No one-size-fits-all frameworks, × no two-year contracts, × no mass out-sourcing to teams outside your time zones, × and no fresh graduates. Just a targeted team with hands-on experience dedicated to solving your problems.

Our goal is to leave your team better than when we started. Think of us as part of your team. Everyone else does.

OUR PROVEN FINTECH TRANSFORMATION PROCESS

4 steps to lead the market.

Market-Leading Strategy

We map priorities, talk to teams, study the market, dig into workflows, and build a clear plan to modernize what matters most.

Elevated User Experience Design

We spot friction. We test real workflows. We design for borrowers, and lenders. We validate with users. We build systems that scale. We get it right early.

Future-Proof Technology, Delivered

We bring senior engineers who thrive in complexity. They untangle legacy code, align with your standards, work inside your stack, and deliver stable releases without slowing you down.

Seamless

Handoff

Everything’s documented. The code is clean. Your team has what they need. Reusable components are in place so you can run with it from here.

Become a market leader in commercial lending.

Book a strategy session to accelerate your path from application to approval. We’ll help you launch faster, streamline funding, and deliver a better experience for every stakeholder — without increasing complexity.

Something Powerful

Tell The Reader More

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Remember:

- Bullets are great

- For spelling out benefits and

- Turning visitors into leads.

Thoughts from our Commercial Lending Experts.

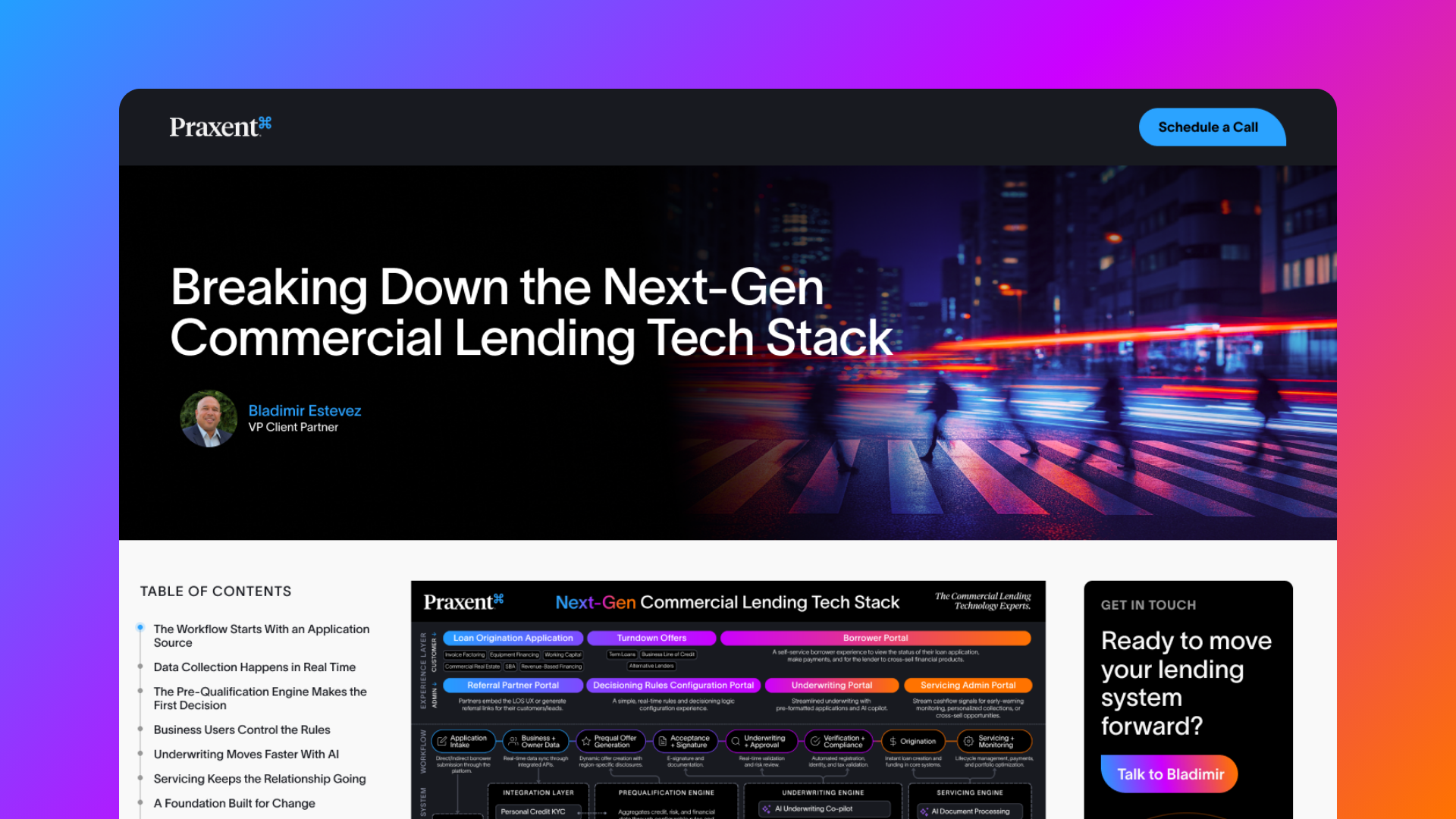

Breaking Down the Next-Gen Commercial Lending Tech Stack

Learn what a next-gen SMB and commercial lending platform includes: real-time API data, pre-qualification, AI underwriting, and servicing insights.

The Future of Equipment Financing: Your 2026 Trends Guide

Explore 2026 equipment financing trends: AI underwriting, digital lending platforms, IoT data, usage-based models, and manufacturing financing growth.

The Future of Invoice Factoring: Your 2026 Trends Guide

Explore the top invoice factoring trends for 2026, from AI to embedded finance, and see how lenders can modernize fast. Get the insights you need now.

The Future of SMB and SBA Lending: 2026 Trends in Modern Lending Platforms

Discover the top SMB lending trends for 2026—from small-balance SBA loans to AI-powered underwriting and API-first lending platforms.

The Executive Guide to AI-Driven SMB Underwriting

Discover how AI streamlines SMB underwriting—cutting manual work, boosting speed, and improving consistency without changing credit policy.