WHITEPAPER: B2B PAYMENT TRENDS TO WATCH IN 2026

How B2B Payment Trends Are Changing in 2026

Real-time payments, account-to-account movement, AR and AP automation, embedded flows, virtual cards, and new global rails are raising expectations across industries.

This guide breaks down the nine trends driving that shift and shows where providers are investing to stay competitive.

Download to see the trends shaping 2026 →

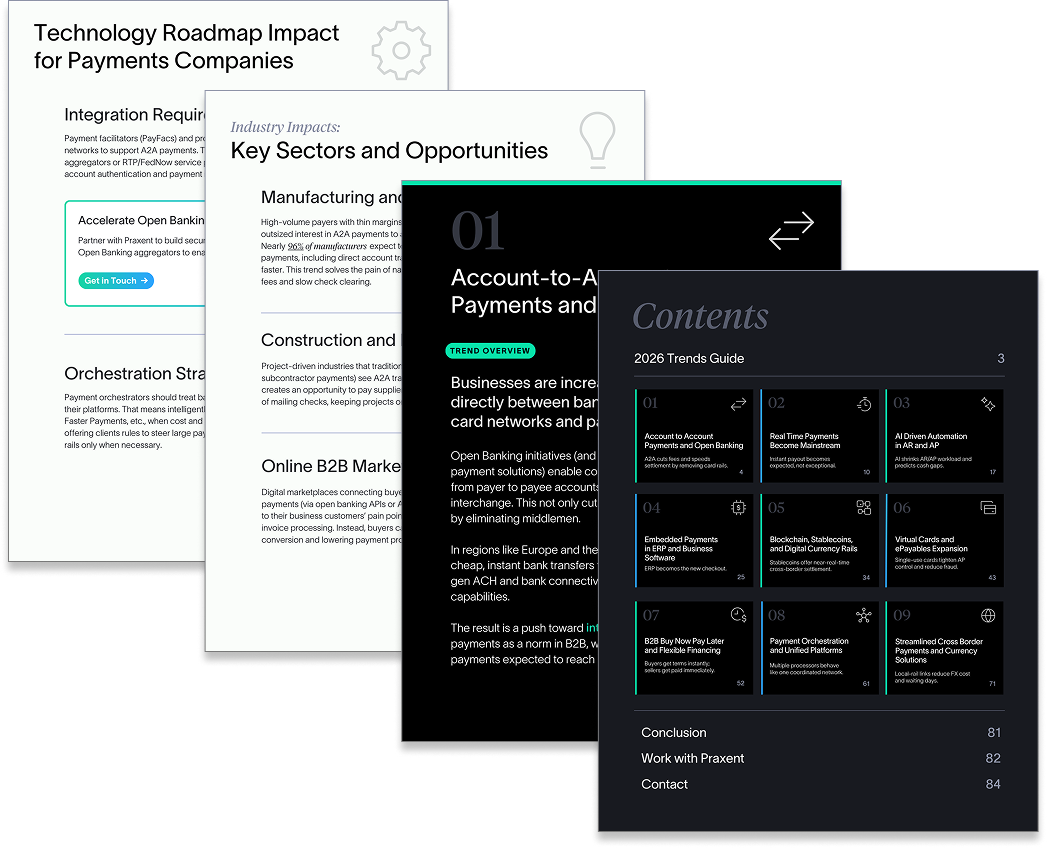

What’s inside this guide: the B2B payment trends to watch in 2026

Get a detailed look at the nine trends shaping B2B payments in 2026, including:

→ A2A and real-time payments changing settlement expectations

→ AI reducing AR/AP workload and improving visibility

→ Embedded payments and orchestration rising across platforms

→ The upgrades needed to move beyond legacy payment systems

DOWNLOAD NOW

See how the 2026 B2B payment trends will impact the industries you serve and how leading platforms are modernizing their systems to keep pace.

PayFacs, processors, and PFaaS providers are adding instant-rail connections, improving bank connectivity, building orchestration layers, issuing virtual cards, and rolling out cleaner cross-border paths. These moves reduce friction, improve cost control, and raise revenue potential.

This guide shows which changes matter most — and how they impact your platform’s roadmap.

Get the 9 trends reshaping B2B payments and what they mean for your platform ↓