THE DIGITAL AUTO-FINANCE EXPERTS

Rebuild your platform for speed, intelligence, and adaptability.

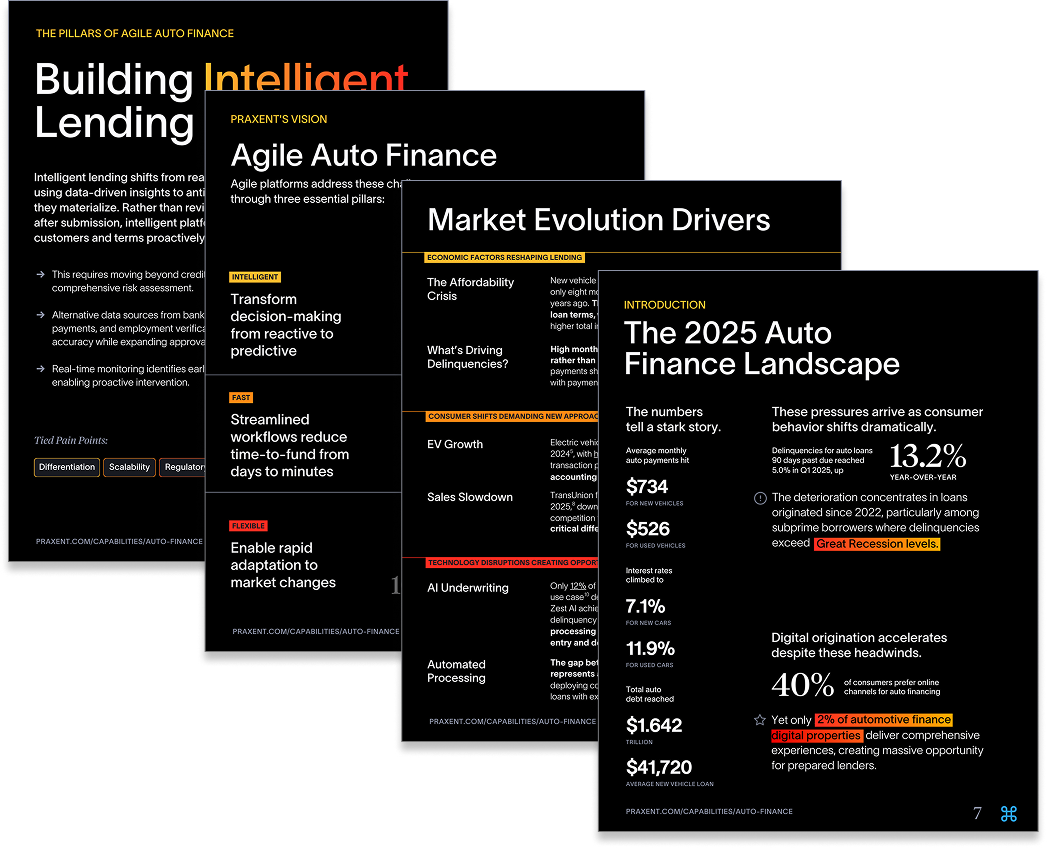

Underwriting. Coordination. Integration. This guide shows how modern lending platforms are being rebuilt - from document intake to risk scoring - to move faster, reduce manual work, and adapt to change without rewrites or delays.

Building for faster funding and smarter decisions? This guide is for you →

What’s in the Guide:

→ 8 blockers slowing down auto lenders in 2025

→ How leading lenders are using modular design to move faster

→ The coordination layer that drives real-time approvals

→ What actually reduces manual reviews (and what doesn’t)

→ Benchmarks for speed, automation, and income verification

DOWNLOAD NOW

Manual reviews, scattered documents, and brittle workflows are slowing lending down. And costing you deals.

This guide shows how modern auto lenders are rebuilding their platforms to fix what’s actually broken — not just underwriting, but the disconnected systems around it.

Learn how intelligent coordination, modular design, and real-time decisions are reshaping the next wave of high-performing platforms.

See how leading lenders are rebuilding their platforms ↓