Annual transactions powered by payments platforms we’ve built

B2B PAYMENTS TECHNOLOGY CONSULTING AND ENGINEERING

Accelerate Payments Integrations. Unblock Revenue Growth

B2B payment leaders are building platforms that keep revenue moving by staying connected. Integrations to partner systems, modern payment rails, and flexible infrastructure clear the bottlenecks that stall deals, helping processors, PayFacs, and orchestrators launch features sooner and deliver merchant experiences built to grow.

Insurance organizations supported through the Payments Platform we built

Fintech integrations

delivered annually

Payment integration challenges are costing you revenue

Every quarter, you lose deals to competitors with pre-built integrations, more modern capabilities, and differentiated experiences. Your engineering team is stretched thin, maintaining existing integrations while your roadmap stalls.

Praxent is the fintech-specialized engineering partner that unblocks your growth.

How We Accelerate Modern B2B Payment Businesses

Fast-Track Platform Integrations

Eliminate integration complexity and capacity issues that hinder deals. Our payments engineers resolve integration bottlenecks, speeding up connections to platforms, processors, and partners.

What we integrate

→ Vertical industry platforms

→ Enterprise systems (ERPs, CRMs, accounting platforms)

→ Core banking and financial systems

→ Multi-processor and gateway networks

→ PayFac as a Service implementations

Next-Gen Payment Infrastructure

Still running monoliths while the market demands instant payments? Our engineers modernize infrastructure and build new capabilities with a deep understanding of compliance, scale, and transaction consistency.

What we build

→ Modern payment capabilities

→ White-label PFaaS platforms and APIs

→ Microservices migration and API development

→ Processing optimization (AI, routing, retry, cost reduction)

→ Compliance systems (KYC/AML orchestration, fraud, audit trails, AI tools)

Differentiated Digital Experiences

Attract and retain more merchants with superior payment experiences. Our engineers build the portals, workflows, and vertical features that make you the obvious choice.

What we deliver

→ Merchant portals (onboarding, dashboards, reporting)

→ Payment workflows (billing, invoicing, recurring payments)

→ Vertical features (healthcare claims, insurance premiums)

→ Value-added services (split payments, payment links, virtual cards)

Our B2B Payments Expertise

ACH

Card Networks

RTP / FedNow

Stablecoins

Wire Transfers

Digital Wallets

BNPL

Who We Help in the B2B Payments Ecosystem

Processors

PayFacs / PFaaS

Orchestrators

Industry Systems We Accelerate in B2B Payments

We don't just understand payments, we understand the systems that drive your revenue: from policy administration systems to accounting software.

Insurance

Policy Administration Systems • Agency Management Systems • Claims Platforms

Travel & Hospitality

Global Distribution Systems • Property Management Systems • Booking Platforms

Healthcare

Practice Management Systems • Revenue Cycle Management • Claims Clearing houses

Advertising

Ad Buying Platforms • DSP Systems • Media Billing Platforms

Construction

Project Management ERPs • Field Service Systems • Accounting Backbones

Logistics

Transportation Management Systems • Freight Platforms • Carrier Systems

B2B Commerce

Enterprise ERPs • Order Management Systems • B2B Marketplaces

Manufacturing

Supply Chain Platforms • Procurement Systems • Industrial ERPs

Why CTOs Choose Praxent for B2B Payments Engineering

- ✔

2-week ramp timeEngineers with deep payments domain expertise

- ✔

Compliance-first mindsetSOC II Type II certified, regtech fluent

- ✔

AI-assisted development practicesreducing development time by 30%

- ✔

10X qualityStringent hiring ensures proactive, collaborative engineers who own outcomes and deliver clean, quality code fast

- ✔

Flexible US/LATAM teamsEmbed in your teams or complete pods

Generic Dev Shops

- ✖

3–6 month learning curveon payments complexity

- ✖

Treat compliance as an afterthought

- ✖

Traditional development velocity

- ✖

Hit-or-miss qualityand technical debt accumulation

- ✖

Rigid offshore modelsTime zone friction, fixed structure

B2B Payments Proven Results

Insurance Payments Platform

Serving 7,000+ insurance organizations

Cleared integration bottlenecks with a pod of payments engineers, completing complex integrations, including Applied Epic Insurance Agency Management System.

Digital Wallet for Payroll Processor

Processing 60+ million transactions annually

Expanded payroll application into a digital wallet, giving employees new financial flexibility while driving increased deposits for the underlying bank.

ENTERPRISE PAYMENT ECOSYSTEMS

50+ Fintech Integrations Annually

Specializing in complex, regulated financial system connections

Engagement Models Built for B2B Payment Teams

Embedded Engineers

Augment your team with payments-fluent talent

Engineering Pods

Complete teams delivering against your roadmap

Project Teams

End-to-end ownership of critical initiatives

Let's Unblock Your Growth

Stop losing deals to integration complexity.

Start shipping faster with Praxent.

Inside the PDF:

→ Use cases for processors, PayFacs, and orchestrators

→ Platform architectures and integrations built for speed and scale

→ Digital services that create user-first payments journeys

→ Proven client results, from x to y

→ Why leading lenders trust Praxent to modernize B2B payments

Download the B2B Payments Use Case ↓

Thoughts from our B2B Payment Modernization Experts

Guide: B2B Payment Trends to Watch in 2026 – Industry Focus and Tech Roadmap

Explore the top B2B payment trends for 2026 — from A2A and RTP to orchestration, BNPL, and cross-border. See what payment companies must build next.

Streamlined Cross-Border B2B Payments and Currency Solutions

Improve cross-border B2B payments with better FX, multi-currency wallets, and local payout methods that cut fees and make global transfers more predictable.

What Payment Platforms Need to Support Blockchain and Stablecoins

See how blockchain, stablecoins, and digital currency rails enable faster cross-border payments, lower fees, and transparent settlement for B2B platforms.

Virtual Cards and ePayables: The Next Big Shift in B2B Payables

Learn how virtual cards and ePayables are transforming B2B payables with better security, control, and rebates—and what payment platforms need to support them.

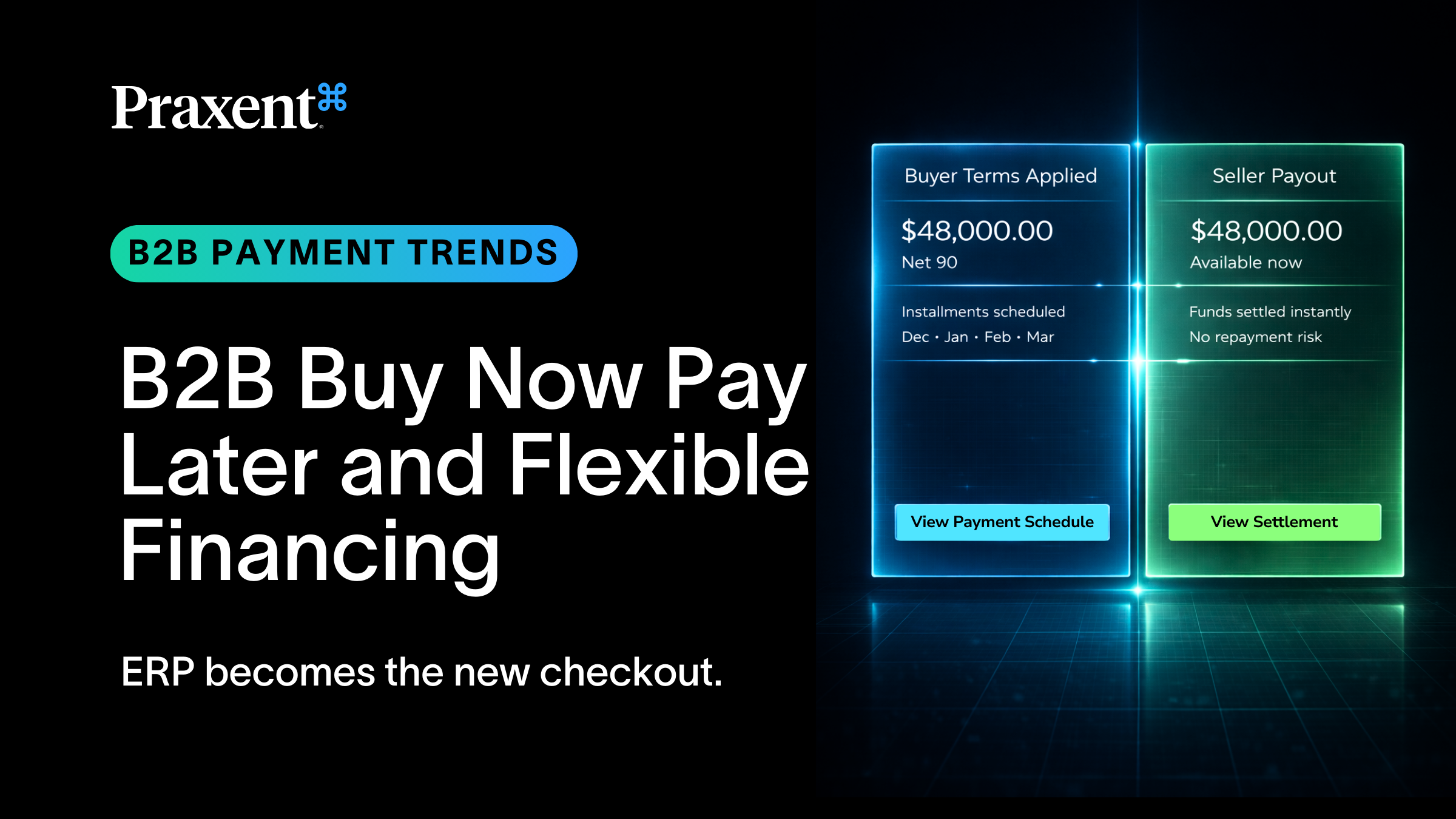

B2B Buy Now, Pay Later (BNPL) and Flexible Financing

Discover how B2B Buy Now, Pay Later and flexible financing reshape payments with instant terms, BNPL APIs, and underwriting. Explore what platforms must build.

Payment Orchestration and Unified Platforms for B2B Payments

Discover how payment orchestration, smart routing, and unified platforms help B2B payments teams boost approvals, cut fees, and scale globally.

AI-Driven Automation for AR/AP in B2B Payments

Discover how AI automates AR/AP workflows, reduces DSO, improves cash flow forecasting, and transforms B2B finance with smarter reconciliation.

Real-Time Payments and Instant Payments in B2B Transactions

Learn how real-time and instant payments improve liquidity, accelerate B2B cash flow, and reshape payment operations for PayFacs and processors.

Account-to-Account (A2A) Payments and Open Banking Payments

Discover how account-to-account payments and Open Banking are reshaping B2B payments with faster settlement, lower fees, and pay-by-bank options. Learn more.

Embedded Payments in ERP and Business Software

See how embedded payments transform ERP and vertical software, streamline onboarding, automate reconciliation, and help ISVs unlock new revenue.

Next step’s yours

Next step’s yours

Put our B2B Payments

experience to work.

Something Powerful

Tell The Reader More

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Remember:

- Bullets are great

- For spelling out benefits and

- Turning visitors into leads.