Get the 9 trends reshaping B2B payments and what they mean for your platform ↓

In 2026, the world of B2B payments is accelerating into a new era. What was once back-office plumbing is now a strategic driver of growth and customer loyalty. Legacy payment rails are breaking under the pressure of globalization and digital business.

The future of B2B transactions is real-time, intelligent, and embedded in everyday workflows.

Below we explore the top trends projected to shape B2B payments in 2026, and for each we highlight the industries most impacted and what payment companies must do to stay ahead.

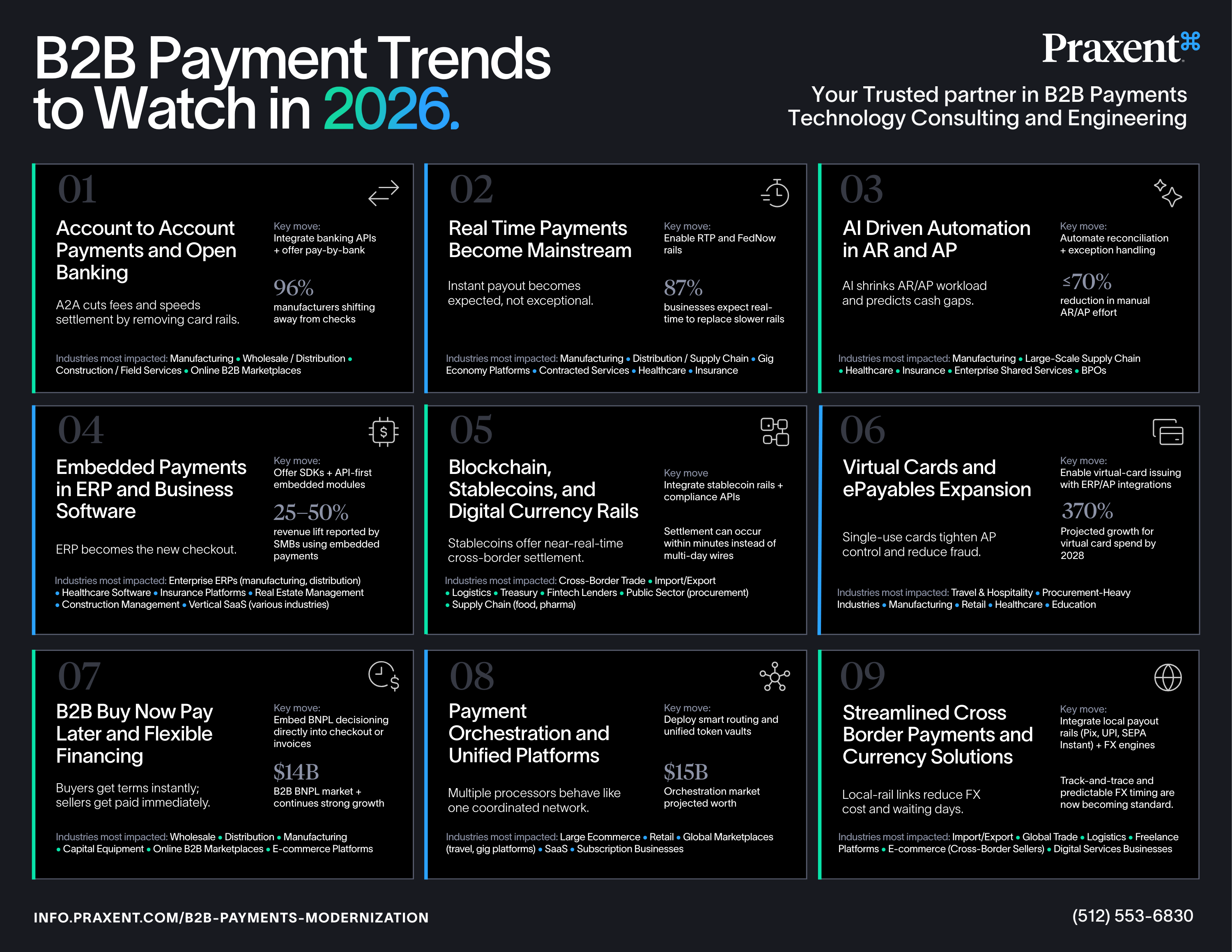

Account to Account Payments and Open Banking

A2A cuts fees and speeds

settlement by removing card rails.

Key move:

Integrate banking APIs + offer pay-by-bank

96%

manufacturers shifting away from checks

Real Time Payments

Become Mainstream

Instant payout becomes expected, not exceptional.

Key move:

Enable RTP and FedNow rails

87%

businesses expect real-time to replace slower rails

AI Driven Automation

in AR and AP

AI shrinks AR/AP workload and predicts cash gaps.

Key move:

Automate reconciliation + exception handling

≤70%

reduction in manual AR/AP effort

Embedded Payments in ERP and Business Software

ERP becomes the new checkout.

Key move:

Offer SDKs + API-first embedded modules

25–50%

revenue lift reported by SMBs using embedded payments

Real Time Payments Blockchain, Stablecoins, and Digital Currency Rails

Stablecoins offer near-real-time cross-border settlement.

Key move:

Integrate stablecoin rails + compliance APIs

Settlement can occur within minutes instead of multi-day wires

Virtual Cards and ePayables Expansion

Single-use cards tighten AP control and reduce fraud.

Key move:

Enable virtual-card issuing with ERP/AP integrations

370%

projected growth for virtual card spend by 2028

B2B Buy Now Pay Later and Flexible Financing

Buyers get terms instantly; sellers get paid immediately.

Key move:

Embed BNPL decisioning directly into checkout or invoices

$14B

B2B BNPL market + continues strong growth

Payment Orchestration and Unified Platforms

Multiple processors behave like one coordinated network.

Key move:

Deploy smart routing and unified token vaults

$15B

Orchestration market projected worth

Streamlined Cross Border Payments and Currency Solutions

Local-rail links reduce FX cost and waiting days.

Key move:

Integrate local payout rails (Pix, UPI, SEPA Instant) + FX engines

Track-and-trace and predictable FX timing are becoming standard

1. Account-to-Account Payments and Open Banking

Trend Overview

A2A payments and Open Banking are reshaping B2B transactions by enabling direct bank-to-bank transfers without card networks. APIs now support faster settlement, lower fees, and better control over cash flow, pushing high-volume industries toward “pay by bank” as a mainstream alternative to cards.

2. Real-Time Payments Become Mainstream

Trend Overview

Instant payment networks like FedNow and RTP are accelerating the expectation of immediate settlement. For B2B, this means faster liquidity cycles, improved supplier relationships, and new opportunities to streamline invoicing, collections, and treasury workflows through 24/7/365 availability.

3. AI-Driven Automation in AR/AP Processes

Trend Overview

AI is eliminating manual accounting work by automating invoice processing, reconciliation, approvals, and exception handling. Finance teams increasingly rely on AI to reduce errors, shorten DSO, prevent duplicate payments, and unlock real-time cash flow insights.

4. Embedded Payments in ERP and Business Software

Trend Overview

Businesses want payments to “just happen” inside the systems they already use. Embedded payments inside ERP, accounting, vertical SaaS, and workflow tools streamline acceptance, payouts, invoicing, and reconciliation — turning software platforms into financial operating hubs.

5. Blockchain, Stablecoins, and Digital Currency Rails

Trend Overview

Enterprise-grade blockchain rails are evolving from experimentation to operational use cases. Stablecoins and on-chain settlement promise lower-cost cross-border transfers, improved transparency, and programmable payment flows that appeal to marketplaces, logistics networks, and global commerce platforms.

6. Virtual Cards and ePayables Expansion

Trend Overview

Virtual cards are becoming a core AP automation tool, offering real-time control, enhanced security, and new rebate revenue models. As procurement digitizes, businesses adopt virtual cards to replace checks, streamline supplier payments, and monitor spend with granular visibility.

7. B2B Buy Now, Pay Later (BNPL) and Flexible Financing

Trend Overview

BNPL is rapidly moving into B2B, giving companies instant access to flexible net terms without requiring suppliers to take on credit risk. By embedding financing directly into checkouts and invoices, platforms boost conversions, increase order sizes, and support cash flow–sensitive buyers.

8. Payment Orchestration and Unified Platforms

Trend Overview

Merchants and marketplaces need redundancy, routing optimization, and multi-processor connectivity. Payment orchestration unifies gateways, improves authorization rates, reduces fees, and ensures global scalability. A single integration now unlocks multiple PSPs, payment methods, and token vaults.

9. Streamlined Cross-Border Payments and Currency Solutions

Trend Overview

Cross-border payments are becoming faster, cheaper, and more transparent thanks to local rails, multi-currency wallets, and improved FX engines. Interoperability across regional networks reduces delays and opaque fees, giving businesses better predictability and global reach.

How 2026 B2B Payment Trends Will Shape the Industry’s Next Phase

B2B payment innovation in 2026 is all about practical, customer-centric advances. Trends like real-time settlement, API-driven bank transfers, process automation, embedded experiences, and smarter orchestration aren’t just tech buzz – they address the core needs of businesses: get paid faster, pay out cheaper, manage cash better, and delight customers/suppliers in the process.

Payment companies and PayFacs that invest in these areas will be positioned to attract new clients and deepen existing relationships, because they’re solving real problems.

In the fiercely competitive payments landscape, delivering concrete value – faster processes, richer data, more flexibility – is what will set a provider apart.

Payments are evolving from a back-office function to a source of competitive differentiation and trust. In 2026, the winners will be those who turn these trends into tangible improvements in how businesses move money.

It’s a challenging roadmap, but also an exciting one: by embracing these trends with purpose, payment companies can help their clients (and themselves) grow faster, operate leaner, and build lasting loyalty in the years ahead.

GET THE WHITEPAPER

B2B Payment Trends to Watch in 2026

.jpg?width=731&height=211&name=Artboard%202praxent-logo-susperscript-no-tag-dark@2x-100%20(1).jpg)

.png?width=780&height=154&name=Praxent%20Logo%202024%20(white).png)

Modernize your Technology, Command your Future SM

Accelerate Payments Integrations. Unblock Revenue Growth.

Partner with Praxent for fintech-specialized engineering that unblocks your growth.

Discover how →

Add comment